February 7, 2024

2024 Dairy Market Situation and Outlook

February 2024

Written by Christopher A. Wolf, Ph.D., Cornell University

2023 Review

2023 was the second year in a row that US milk production was flat increasing only 0.04% from 2022 levels which, in turn, was flat compared to 2021. Contrast that to the long-run annual growth rate of about 1.7% in national milk production. Typically, one would have expected the high milk prices and profitability in 2022 to result in a robust increase in milk production. However, there were several factors which blunted the production response. Perhaps most important were the cooperative base programs which reflect a longer-term structural challenge with aligning milk production with processing capacity.

A second factor dampening milk production last year were the high feed prices. The US corn price averaged about $6/bu being over $6.50/bu for the first seven months of the year. These feed prices resulted in an income-over-feed-cost margin that averaged $6.74/cwt in 2023 being below $4/cwt in June and July. This was much lower than historic averages and dairy farm profitability values for 2023 are likely to come in well below the long-run average even as the cost of borrowed capital was much higher. The only silver lining of these historically low margins were the Dairy Margin Coverage payments which generated significant payments for participants.

A third factor in the small supply response were high cattle prices. Cull cow prices peaked at $1.15/lb and remained over $1.00/lb to end 2023. Total US cattle inventory (beef and dairy total) dropped 2% in 2023 to the smallest level since 1951 and there are currently no signs that the beef herd will build back anytime soon. These cattle trends are bullish for beef prices moving forward. The use of sexed semen has allowed dairy farmers to select specific dams for replacement heifers while using beef semen on the remainder of the herd. The dairy-beef cross calves have been generating revenues to support farm income.

Meanwhile, USDA reported replacement milk cow prices were ten percent higher to start 2024 than they were a year earlier. Much has been made recently of the relatively small number of replacement heifers as dairy farmers increasingly utilize beef semen in their dairy herd. The low dairy heifer numbers might impact the supply response should high profits emerge. However, keep in mind that reproductive performance (conception rate, calving interval), age at first calving, calf mortality and other measures have improved over time meaning that less heifers per milk cow are needed.

2024 Milk Price Outlook

Studying dairy farm profitability over the past 23 years reveals that there are three factors highly correlated with high profit versus low profit years. The first is relative growth in milk supply. Long-run trend is 1.7 to 1.8 percent and growth at that level has resulted in average farm milk and profit since 2000 (Table 1). Slow milk production increases, whatever the cause, result in higher milk prices while above trend milk supply growth has the opposite impact. The second factor is change in quantity of product exported compared to the previous year. High milk prices are related to large increases in exports over the previous year with those years having an increase of four times the average increase. In contrast, low milk price years were associated with much lower growth in export quantities. The third factor is ending stocks of dairy products (in milkfat terms). When ending stocks finished below the beginning value milk prices at the farm level were strong. If stocks grew above trend levels—recall that consumption was increasing this entire period so we would expect stocks to grow to maintain stocks to use ratios—then milk prices were low. To be clear, these factors are jointly determined with milk prices—that is a draw down in stocks happens when demand is strong. These factors provide a guideline for assessing potential market directions for 2024.

Table 1. Factors Related to Farm Milk Price and Profit 2000-2022

|

Milk Price and Farm Profit |

Milk Supply |

Exports |

End Stocks |

|

% Change Year over Year |

|||

|

Good |

0.95 |

31.58 |

-1.98 |

|

Average |

1.76 |

7.36 |

6.25 |

|

Poor |

2.01 |

1.41 |

9.66 |

Domestically, the milk production response is likely to remain sluggish again for the coming year meaning that price variation will likely be a function of market demand. Domestic demand has been solid if unspectacular. Core inflation returned to Federal Reserve target levels in the second half of 2023 while unemployment remained low and real wages grew. Meanwhile unemployment has consistently remained below four percent. It looks increasingly likely that a long-dreaded recession may be avoided barring some external shock such as a major geo-political conflict. If inflation continues to moderate to target levels and the labor market does not show signs of overheating, the Federal Reserve may begin to cut the benchmark interest rate in 2024 which should help greatly with farm and household interest costs moving forward as well as supporting consumption spending.

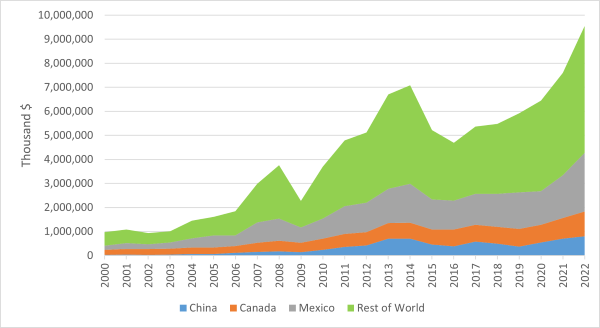

With, perhaps, less risk on the domestic front at the current time, the potential for milk price variation is more focused in world markets. In the past couple of decades, the growth in dairy exports has helped support a growing milk production where we have consumed virtually all of the butterfat domestically and most of the dairy proteins but exported excesses. The result is that the US dairy product prices for the most heavily exported products—nonfat dry milk, dry whey and lactose—are highly correlated with world prices. US dairy product prices for the major dairy commodities have been at world prices for years. Total value of US dairy exports from 2000 through 2022 are depicted in Figure 1 along with the specific values of exports to Canada, Mexico and China. One aspect that stands out is that there were peaks in 2007, 2011 and 2022. It is not a coincidence that these years were high farm milk price and profit years. Although somewhat obscured by the scale of the figure, China was of key importance in hiking export demand for US dairy products particularly in 2014 and 2022. At the current time China seems mired in economic doldrums with a large housing price bubble and below expected economic growth. As such it seems unlikely that China will be the source of a surge in export demand in the near future. At the other end of the spectrum, the Mexican economy has recovered from issues around the pandemic and provides a strong source of demand for US dairy products.

Figure 1. Value of US Dairy Exports, 2000-2022

With respect to international milk production, both New Zealand the European Union continue to search for a way forward to balance milk production with environmental regulations. Through November 2023, EU milk production was essentially flat year over year at +0.1% while New Zealand milk production was -0.7% compared to 2023. At the current time, US milk prices are below the EU but above New Zealand. Thus, we expect US producers to compete well with the EU for cheese markets this year but may struggle in direct competition with New Zealand.

The other aspect of supply that is closely related to milk price outlook are dairy product stocks. Total cheese stocks in December 2023 were down 0.2 percent over a year earlier. American cheese stocks (cheddar) were up 1.5 percent over a year earlier. Butter stocks finished 2023 down 7.9 percent from a year earlier but in line with where they finished 2021. It’s worth noting that this level to led directly into high Class IV prices for 2022. Given the new cheese capacity scheduled to come online, it is likely that Class IV price will continue to be above Class III price.

As of the time of writing, the most recent USDA World Agricultural Supply and Demand Estimates (WASDE) report forecasts an All Milk price of $20/cwt along with a Class III price of $16.cwt and a Class IV price of more than $19/cwt. Meanwhile, current dairy futures prices are more optimistic (see table).

USDA is forecasting a corn price of $4.80/bu and soybean meal price of $380/ton as of this writing. Current futures prices are more bearish on corn and soybean meal prices. US corn yields set a record in 2023 and the carryout stocks were very large. Both markets are anxiously watching the crops in South America which could push prices in either direction.

The resulting margin forecast is for low initial margins to recover to above average margins in the second half of 2024. Current margins are not great but $20/cwt milk with $4.50/but corn is a whole lot better than $20/cwt milk price with $6+/bu corn which occurred in 2023.

Table 2. Milk and Feed Price Forecasts for 2024

|

|

All Milk |

Class III |

Class IV |

Corn |

Soybean Meal |

|

|

$/cwt |

$/cwt |

$/cwt |

$/bu |

$/ton |

|

|

|

|

|

|

|

|

USDA |

20.00 |

16.10 |

19.35 |

4.80 |

380 |

|

|

|

|

|

|

|

|

Futures Market |

21.00 |

17.45 |

19.55 |

4.57 |

353 |

Policy Update

The Federal Milk Marketing Order Hearing that began in August 2023 wrapped up at the end of January 2024. The Hearing addressed proposals ranging from Class I differentials to make allowances to what is included in weekly dairy product surveys. Part of this reflects the fact that the FMMOs are showing their age ad have not been updated other than individual orders since 2008. The process still has a ways to go, though, as there are many more months of revisions and comments before USDA will issue a decision that dairy farmers will vote on (perhaps through their cooperative). It will be mid-2025 at the earliest before changes will be realized.

The Farm Bill received an extension at the end of 2023 to avoid expiration of major programs. Look for a new bill towards the end of 2024. The Dairy Margin Coverage program for 2024 should be available soon and signup will be retroactive to January.

|

Dr. Christopher A. Wolf E.V. Baker Professor of Agricultural Economics Dyson School of Applied Economics and Management Cornell University |

Editors: Chris Laughton and Tom Cosgrove

Contributors: Dr. Christoper A. Wolf and Chris Laughton

View previous editions of the KEP

Farm Credit East Disclaimer: The information provided in this communication/newsletter is not intended to be investment, tax, or legal advice and should not be relied upon by recipients for such purposes. Farm Credit East does not make any representation or warranty regarding the content, and disclaims any responsibility for the information, materials, third-party opinions, and data included in this report. In no event will Farm Credit East be liable for any decision made or actions taken by any person or persons relying on the information contained in this report.

2024 Dairy Outlook Webinar

On Wednesday January 24 Farm Credit East and Dr. Christopher Wolf of Cornell University presented a recap of 2023, and an outlook for what 2024 may bring us in global dairy markets. Following Dr. Wolf’s presentation, Dr. Marin Bozic of the University of Minnesota discussed risk management strategies in light of the market outlook.