September 8, 2023

Federal Milk Marketing Order Hearing Underway: A Summary of the Major Issues

Volume 17, Issue 9

September 2023

Source: National Milk Producers Federation

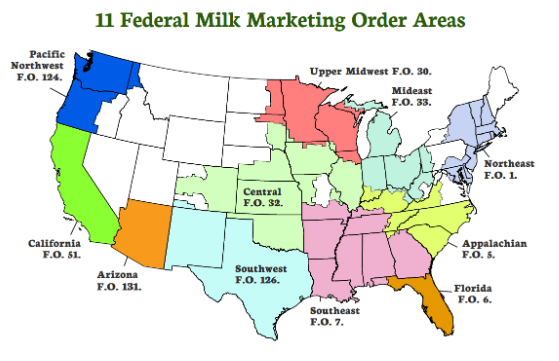

There are 11 Federal Milk Marketing Orders across the country, covering approximately 75% of U.S. milk production. Federal orders set minimum prices paid to farmers, ensure payments are accurate and timely, and provide market information. Notably, federal orders do not set the actual price of raw milk, they set a minimum price that must be paid, and actual market prices can, and sometimes do, exceed these levels in times of tight supply. In practice, however, in most recent years, the FMMO minimum price is the actual price paid to farmers, making it highly significant.

Importantly, FMMOs do not guarantee farmers a favorable price for their milk. At best, they help all farmers covered under one of the orders to be treated consistently, and get maximum value for their milk, given the underlying market conditions. Minimum prices for raw milk are derived from the actual wholesale prices of dairy products like cheese, butter and nonfat dry milk and are intended to reflect the current market conditions.

The last comprehensive revision to the FMMO system occurred in 2000. Since then, industry dynamics have changed significantly, and a growing number of voices have been calling for reforms to the system. Beyond that sentiment, however, agreement breaks down, and there are many differing views on what that reform should look like.

There are five main categories that the USDA has determined should be addressed. The hearing began August 23 in Carmel, Ind., and is expected to continue for five to seven weeks.

The main categories USDA has identified are as follows:

- Class III and IV Formula Factors (Make allowances)

- Base Class I Skim Mik Price (Class I mover issues including switching back to the “higher of” formula)

- Milk Composition (updating component factors in milk formulas)

- Surveyed Commodity Products (updating products in the National Dairy Product Sales Report)

- Class I & II Differentials (updating the Class I pricing surface)

Make Allowances

While all five of these categories are important, one of the most significant (and most controversial) set of issues to be addressed are those surrounding #3; the Class III and IV formula factors, including make allowances.

Make allowances are an estimate of dairy processors’ cost of converting milk into finished products and serves as the mechanism for converting the market prices for manufactured products into the raw milk price farmers receive. They are established at fixed rates, and were last updated in 2008, based on data from 2006 and 2007.

Milk pricing is done via complicated formulas, based on how the milk is used. Class I milk is fluid milk for drinking (and is usually the highest price); Class II milk is soft dairy products like ice cream, yogurt, and cottage cheese; Class III is hard cheeses, cream cheese and whey; and Class IV is butter and dry products such as milk powder.1

Make allowances are a key factor in determining how much milk processors pay for raw milk. Since costs have risen significantly over the past 16 years, many dairy farmers and processors alike feel that they should be updated. Insufficient make allowances could negatively impact both handlers and farmers by making dairy processing less attractive to investment, and shifting the investment that does occur towards low-cost processing plants, which typically make lower value commodity products. On the other hand, increasing make allowances, at least in the short term, would lead to lower prices for farmers by allocating more of value of the wholesale dairy product prices that determine FMMO prices to the cost of manufacturing, meaning less of the value would be attributed to the farm value of milk.

Make allowances are a key aspect of processing profitability and appropriate levels are important for maintaining dairy processing sector profitability and making the sector attractive for investment, particularly for higher-value dairy products increasingly in demand worldwide. It is thus in the interest of processors and dairy farmers alike to have appropriate make allowances that encourage investment in the processing sector.

As might be expected, however, agreement breaks down over how much make allowances should be changed, with groups representing processors generally in favor of greater increases, and groups representing dairy farmers generally in favor of much smaller increases. Two of the most notable proposals come from the International Dairy Foods Association (IDFA), which represents processors, and the National Milk Producers Federation (NMPF), which represents farmer owned cooperatives (some of which own processing facilities).

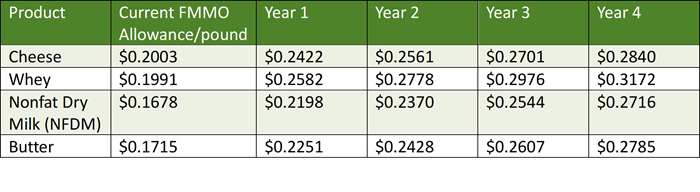

The IDFA proposal, while far-reaching, would, in a nutshell, raise make allowances significantly over a 4-year period.

Source: Federal Register, Proposed Rules

A major challenge in the debate over make allowances is that while increasing the make allowance will result in an immediate reduction in the minimum price for milk, the concern is that not updating the make allowance (resulting from underinvestment in processing infrastructure), is more uncertain and long-term, even though it could be significant.

Some organizations representing dairy farmers, including California Dairies, Inc. and several prominent cooperatives, have pushed back against this proposal, questioning the data it is based on, and contend that it could lower the U.S. all-milk price by $1.42 per hundredweight (cwt.).2

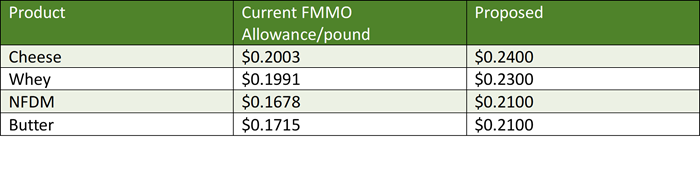

While some farmer organizations oppose any increase in make allowances, the National Milk Producers Federation (NMPF), is seeking a middle ground in the discussion proposing smaller increases:

Source: National Milk Producers Federation

Class I Mover

Another area of possible reform relates to the Class I mover. As with make allowances, this too has proven to be controversial, with processors and farmers generally lining up on opposite sides of the debate.

Under the current Class I and II pricing formulas, there is a 25–40-day lag in the milk prices for fluid/beverage milk (Class I) and soft products (Class II) because they are derived from the previous month’s product prices.

Another issue is that due to a change in the 2018 farm bill, the price paid for Class I (fluid) milk must be at least $0.74/cwt. over an average of the prices for Class III and IV. Previously, the Class I price was based on the higher of- Class III or IV, rather than the average of the two. Some producer groups have proposed eliminating advanced Class I pricing and reverting to the “higher of” pricing formula. Some processing groups have opposed these suggestions, saying that the existing pricing formulas facilitate hedging and risk management practices for processors.

Milk Composition

NMPF and others introduced proposals to amend the milk component factors in Class III and IV skim milk price formulas. It has been noted that farmers have made improvements over the years with genetics, nutrition, and overall production, in response to dairy markets demanding higher fat, protein and other solids. American Farm Bureau Federation (AFBF) Economist Danny Munch said, “The argument here is that the existing component factors and the formulas that are used in multiple-component pricing are out of date, because farmers have done all these things that have improved and created higher percentages of these components in milk.” Many producers feel that these proposals would more appropriately compensate farmers for the components of their milk.

Surveyed Commodity Products

Four proposals will be discussed to determine how to best establish minimum prices under FMMOs. USDA currently uses the National Dairy Product Survey Report (NDPSR) to determine market prices received by dairy manufacturers which are then converted, using make allowances and other factors, into the milk price farmers receive. The current products surveyed now are:

- Salted Butter

- Cheddar Cheese, 40-lb blocks

- Cheddar Cheese, 500-lb barrels

- Dry Whey

- Nonfat Dry Milk

Proposals suggest adding other dairy products to the survey, including 640-lb Cheddar cheese blocks, unsalted butter, and Mozzarella cheese (which is a larger share of the overall cheese market than Cheddar).

Class I and II Differentials

Currently, every U.S. county is assigned a fixed Class I location differential (which range from $1.60-6.00/cwt.) based on the supply and demand characteristics of the region. To support production and marketing in milk-deficit regions, location differentials are added to the base value of Class I milk to determine the total class value. The current Class I differentials were established in 1998 with a minor update in 2008.

The premise behind Class I differentials is to ensure supply to fluid (Class I) plants. Dairy groups argue that many of the factors used to estimate differentials have effectively changed to the point that current differentials no longer ensure an adequate supply of milk to many plants. In addition, Class I, or beverage milk consumption, is a declining share of overall dairy product sales. AFBF and NMPF support increasing Class I differentials, along with possibly adding seasonal considerations to the differentials given that milk supply and demand shifts with the time of year. The Milk Innovation Group (representing milk processors) suggests that Class I differentials should be reduced.

Conclusion

In summary, while both dairy producers and processors generally agree that changes need to be made there are a number of differing opinions on FMMO reform That agreement, however, breaks down when it comes to the details of what those changes should look like. This article covers some of the major issues that are being discussed, but there are 22 proposals overall being considered.

The hearing is currently underway and is expected to continue for several weeks. Individual dairy producers can participate in the hearing either in-person or virtually. For more information, see: https://www.ams.usda.gov/rules-regulations/moa/dairy/hearings/national-fmmo-pricing-hearing

1 Class I price formula: https://www.ams.usda.gov/sites/default/files/media/CalculatingClassIPrice.pdf

Class II price formula: https://www.ams.usda.gov/sites/default/files/media/CalculatingClassIIPrice.pdf

Class III price formula: https://www.ams.usda.gov/sites/default/files/media/CalculatingClassIIIPrice.pdf

Class IV price formula: https://www.ams.usda.gov/sites/default/files/media/CalculatingClassIVPrice.pdf

2 https://www.ams.usda.gov/sites/default/files/media/CDI_DFA_LOL_MDVA.pdf

Editor: Chris Laughton

Contributors: Tom Cosgrove and Chris Laughton

View previous editions of the KEP

Farm Credit East Disclaimer: The information provided in this communication/newsletter is not intended to be investment, tax, or legal advice and should not be relied upon by recipients for such purposes. Farm Credit East does not make any representation or warranty regarding the content, and disclaims any responsibility for the information, materials, third-party opinions, and data included in this report. In no event will Farm Credit East be liable for any decision made or actions taken by any person or persons relying on the information contained in this report.