October 1, 2023

Agricultural Economic Outlook: What Do Futures Markets Say About 2024?

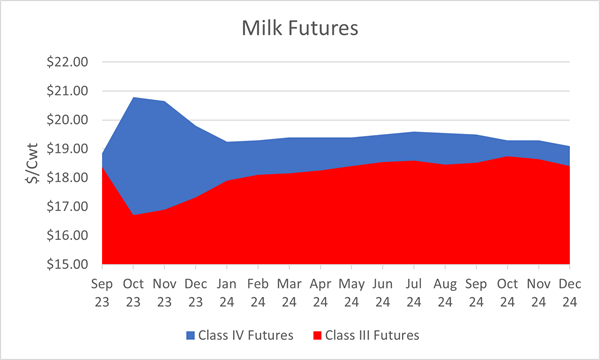

Commodity futures markets play an important role in agriculture. Many farmers use them directly or indirectly as they manage price risk for their operations. Dairy futures, for example, are the underpinning of the Dairy Revenue Program (DRP) insurance policy.

But even for farms that don’t or can’t use futures markets as part of their formal risk management plans, they can provide insights into market participants’ expectations. Apart from commodity futures markets, there are a variety of general and industry specific forecasts available that can inform business planning.

Futures markets provide a window into price movements between now and the contract date.

So as farm businesses enter the last quarter of 2023 and start looking ahead to 2024 budgets, what do futures markets and other economic forecasts suggest is around the corner?

Milk futures show a narrowing gap between Class III and IV prices, and a slight decline in prices in 2024 compared to 2023.

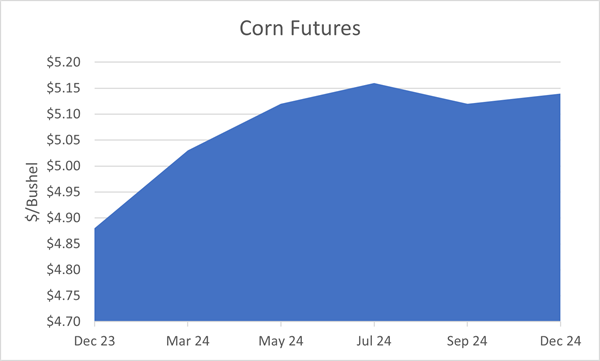

Corn futures show rising prices through the storage season, and a slight decline at 2024 harvest time.

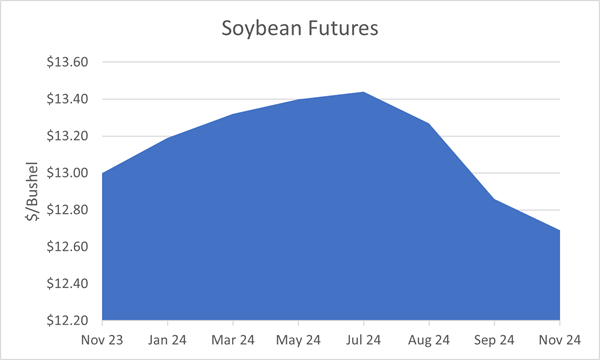

Soybean futures indicate rising prices through July 2024, and then a drop in prices through harvest season. These suggest that we will see feed costs increase through the first half of 2024.

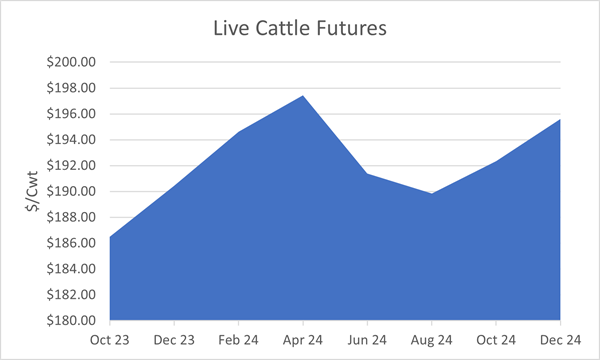

Live cattle futures show some ups and downs, with the average pricing in 2024 being higher than in 2023.

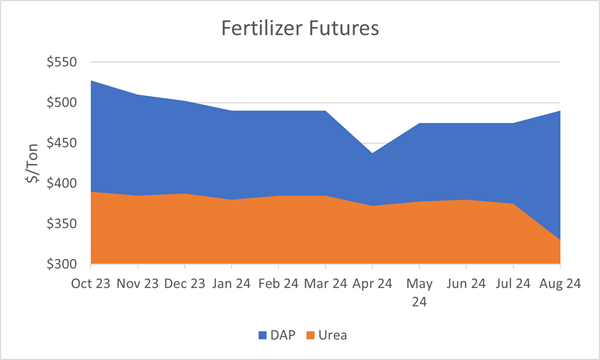

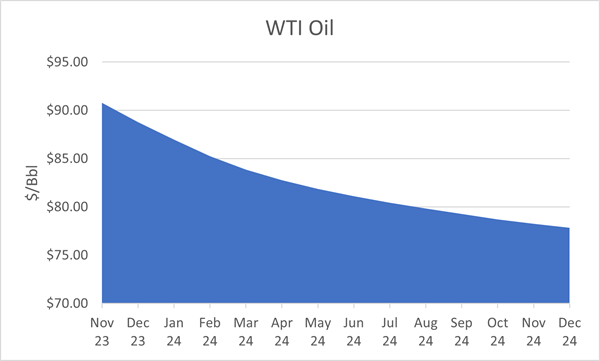

Fertilizer futures show slightly declining prices through next season, as do oil futures.

Altogether, futures markets suggest that we could have another year of elevated input costs and tighter margins for agriculture.

For the general U.S. economy, overall GDP growth is projected to slow in the fourth quarter, and perhaps experience a shallow recession in early 2024, before recovering later in the year. While the U.S. economy has thus far proven remarkably resilient, the impact of a slowing global economy and numerous interest rate hikes are building headwinds for U.S. economic growth. Forecasts suggest that real (inflation-adjusted) GDP growth for 2023 will come in at 2.1-2.3% and decline to +0.8-1.5% in 20241. While a slowing economy may bring some leaner times for Americans, it is generally welcome news for the Federal Reserve, which has hiked rates 11 times since March 2022, in an effort to fight persistent inflation. These rate hikes have, in large part, had the intended effect, which is to cool the economy and lower inflation, yet avoid significant increases in unemployment.

We have seen a marked slowdown in inflation, as the rate of price increases has declined from a peak of over 9% in June 2022, to 3.7% in August (year-over-year). While this reduction in price hikes is welcome news, it’s worth noting that prices are still rising, just not as quickly as they were in the recent past. Falling energy prices have been a big part of this slowdown, which is good news, but masks the impact of price increases in other goods and services.

For agriculture, this means that while farmers may be paying a little less for energy and fertilizer than they did last year, other costs are likely to remain elevated or increase further.

Source for all futures charts: CME Group (as of September 28, 2023)

1 The Conference Board, Moody’s, U.S. Federal Reserve

Editor: Chris Laughton

Contributors: Tom Cosgrove and Chris Laughton

View previous editions of the KEP

Farm Credit East Disclaimer: The information provided in this communication/newsletter is not intended to be investment, tax, or legal advice and should not be relied upon by recipients for such purposes. Farm Credit East does not make any representation or warranty regarding the content, and disclaims any responsibility for the information, materials, third-party opinions, and data included in this report. In no event will Farm Credit East be liable for any decision made or actions taken by any person or persons relying on the information contained in this report.

Tags: ag economy, outlook, risk management