August 29, 2023

2023 has been a challenging year for farmers, and many may see payments from their crop insurance policies or federal crop disaster payments. This is your reminder that crop insurance proceeds and crop disaster payments must be reported by farmers as income.

Generally, crop insurance payments are included in the current year taxable income when they are received. However, a farmer can elect to postpone the recognition of all, or part of the crop insurance proceeds or disaster payments as income until the following year. Electing to defer the taxability of these payments presents a tax planning opportunity for farmers that the Farm Credit East tax team can help navigate.

A farmer can make this election if:

- They use the cash method of accounting,

- They receive crop insurance/disaster payments in the same year as crops were damaged or destroyed, and

- They would normally have reported income from the crops in a following tax year under their normal business practice.

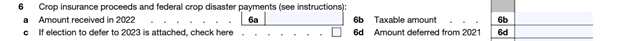

Farmers can make this election to defer income from crop insurance and disaster payments to a following year by reporting the full amount received on line 6a of the Schedule F Profit and Loss from Farming to match the 1099 they will receive. The taxable amount is reported on line 6b with Box 6c checked to indicate making the election to defer. Box 6d is provided as a place to accurately report any payments elected to be deferred from previous year.

Cross section of the 2022 Schedule F for form 1040 showing Crop Insurance.

To complete the election, a statement needs to be submitted with the return containing the farmer’s name and address; declaration that the farmer is making the election deferral under Internal Code Section 451(f); information identifying the crops damaged or destroyed, the cause of the destruction and the dates that it occurred; a declaration that the income would have been included in a following year under the farmer’s normal business practice; and lastly, the insurance carrier name that made the payments.

Our Crop Growers team is happy to provide more information regarding insurance policies and their use as a risk management tool.

It is important to keep accurate records and report the deferred taxable crop payments in the following year. While this strategy can help reduce taxable income in a difficult year, it can also create a more challenging tax scenario for the following year when the income is to be realized. Tax planning with Farm Credit East’s knowledgeable tax specialists can help you make decisions and see if this deferment election is right for your situation.