March 1, 2023

2023 Maple Syrup Outlook

Volume 17, Issue 3

March 2023

2023 Maple Syrup Outlook

Written by Mark Cannella, Extension Associate Professor, University of Vermont

U.S. Maple Syrup Outlook

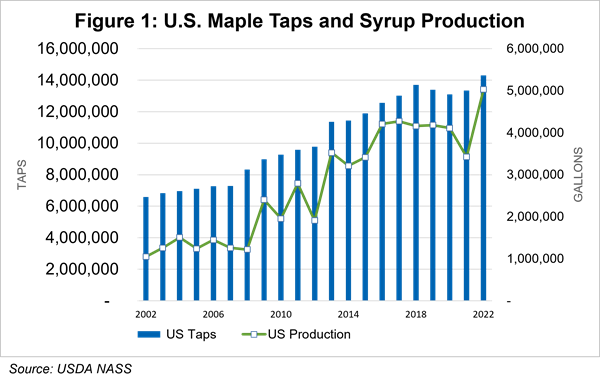

In 2022, United States maple producers generated the largest syrup crop on record in recent history. By late 2022, however, markets were described to be stabilizing or demonstrating slow growth that was much slower than the prior two years. The repercussions of 2022’s record crop and the timing of that crop are likely to be felt well into the 2023 sales season.

Major U.S. syrup buyers were critiqued in 2020 for what was considered too slow of a price increase as COVID-demand surged. This moment was followed by a disappointingly low U.S. syrup crop in 2021, lackluster price increases and a developing concern that inventories were shrinking fast while demand continued to grow.

From late 2021 into 2022 a significant amount of syrup was purchased at much higher prices to rebuild inventories and avoid market interruptions. This high-cost syrup, matched with increased cost-to-sell, resulted in a lagged increase to final consumer prices but an eventual recognition of macro-inflation pressures and maple specific factors.

U.S. buyers are signaling that the compounding factors of a 2022 crop carry-over, softening market demand and the lower cost from Canadian syrup imports may depress 2023 prices regardless of the size of the upcoming crop.

Over 85% of U.S. maple syrup consumption is related to bulk-packed syrup, large chain grocery-club sales and other ingredient markets. The bulk market forecasts, however, miss a large part of the full maple syrup story. Maple producers at all scales are mainly owner operated and family businesses. Small family businesses and their direct connection within communities and forest ecosystems still have a large influence on the culture of maple (see Strategic Outlook section below).

Quebec Maple Outlook

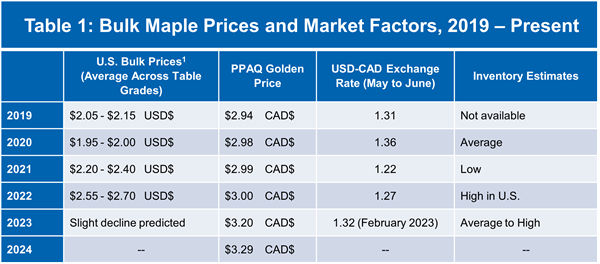

A new pricing agreement has been set by the Quebec Maple Syrup Producers (PPAQ) to cover the 2023 and 2024 marketing cycles. This two-year agreement, rather than the previous three-year period, recognized the criticism that the prior multi-year agreement had limited ability to respond to inflationary pressures over the past two years. The new PPAQ agreement establishes an increased base price for higher quality grades and also includes more penalties for density and off-flavors. These penalties signal a desire to rebuild a strategic reserve with higher quality syrup and incentivize accurate grading measurements by producers.

Similar comments come from U.S. buyers facing dark syrup issues. Strong demand for dark syrup is complicated by potentially higher instances of off-flavors in dark or late season syrup. Buyers are weary of taking on poor quality syrup and the industry at large is aware of the risk of poor quality syrup impacting the consumer experience.

In 2021, the PPAQ authorized a large increase of taps eligible for production. It is estimated that one third of the seven million tap release was in production by 2022 and that slightly over half of the total seven million tap expansion will be in production in 2023. This leaves at least one more year of production expansion set for Quebec in 2024 as all taps become operational.

Financial Market Factors

More dramatic USD-CAD currency exchange rates with a strengthening U.S. dollar into 2023 enhance price competitiveness of Canadian syrup entering U.S. markets (See Table 1). Interest rate increases are hitting the maple sector at all levels and will amplify a cost-price squeeze in 2023. The cost for asset replacement, expansion and operating credit now comes at a higher cost to producers and will increase cost of production in 2023. Syrup buyers and sellers will face increased capital costs to take on inventory plus sustained cost increases for packing, sales and delivery. Buyer-side factors lead to predictions of declining prices for 2023 to below $2.50 per pound on higher grades (not including processing grades or defects).

Strategic Outlook

U.S. maple producers, associations and sellers are looking ahead to position their sector for continued growth, sustainability and preparedness. Key policy issues are expected to emerge related to water quality and reverse osmosis discharge practices. Food safety is seen as an asset to this lower-risk (pasteurized) product and a combination of required or voluntary programs are forming to maintain producer best practices and ensure a message of quality and safety to the marketplace.

Labor supply is a looming concern in regions with larger scale production and a need for hired labor to operate businesses. Many smaller enterprises are expected to scale up to over 10,000 taps to gain efficiencies in production and marketing, but this is occurring in regions with stable or declining populations and limited workforce capacity.

A desire to modernize consumer communications is resulting in a convergence of research and association advocacy. New market research has revealed the majority of consumers still have trouble differentiating pure maple syrup from other table syrups that use corn syrup as the primary ingredient. The maple industry is also working to add rigor to claims of environmental sustainability through improved research partnerships. Syrup markets are either expecting or responding to a linkage with climate change and atmospheric carbon contributions being included in product descriptions. The maple industry is moving to support better measurements of a number of sustainability indicators in order to more fully tell its story and to compete with emerging claims from other competing sweetener categories.

1 U.S. conventional prices posted in able. Organic premium payments are approximately +$0.15 - +$0.20 per pound.

Editor: Chris Laughton

Contributors: Mark Cannella and Chris Laughton

View previous editions of the KEP

Farm Credit East Disclaimer: The information provided in this communication/newsletter is not intended to be investment, tax, or legal advice and should not be relied upon by recipients for such purposes. Farm Credit East does not make any representation or warranty regarding the content, and disclaims any responsibility for the information, materials, third-party opinions, and data included in this report. In no event will Farm Credit East be liable for any decision made or actions taken by any person or persons relying on the information contained in this report.

Tags: outlook, maple syrup production