April 6, 2021

Farm Credit East Production Cost Index Reaches New High

Contents

Volume 15, Issue 4

April 2021

Click here for a PDF version of this month's issue.

Farm Credit East Production Cost Index Reaches New High

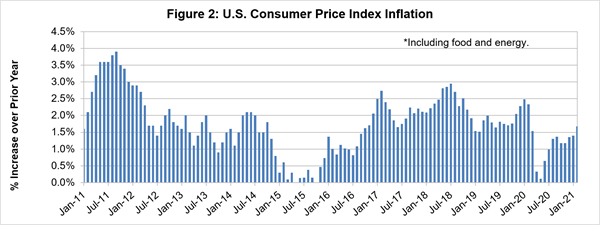

If you’re seeing rising input costs on your farm, it’s not just you. Across the board, as the United States emerges from the COVID-19 economic crisis, prices are rising. While overall inflation (Figure 2) may remain fairly low by historical standards, prices for many common farm inputs have increased substantially recently. Availability is also an issue as supplier lead times hit a recent high last month.1

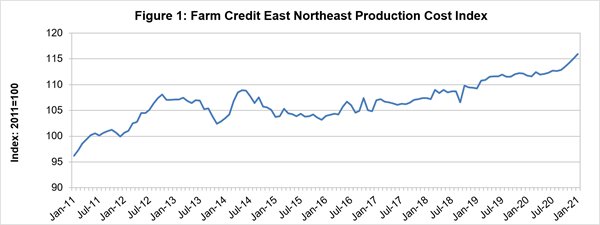

The Farm Credit East Production Cost Index, after experiencing a plateau in 2019-2020, shifted to an upward trajectory in 2021, as seen in Figure 1.

Source: USDA Census of Agriculture, NASS Prices Paid Index, Farm Credit East estimates

Source: U.S. Bureau of Labor Statistics; Including Food and Energy

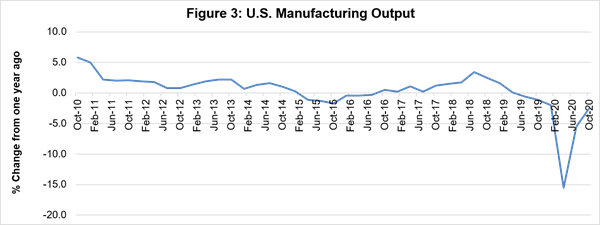

This is being driven by a combination of factors. One is that COVID-19 shutdowns and restrictions have taken a bite out of the supply of many goods across the country and around the globe. Many factories, plants and other facilities either shut down for a period or reduced their capacity to keep workers safe, and in some cases because of anticipated reduced demand. Figure 3 shows the dramatic dip in U.S. manufacturing output in the first half of 2020. However, for many goods, demand has returned to pre-pandemic levels, and even higher, in some cases. Inventories are low, and many suppliers are now rushing to meet a surge of demand.

For products that are imported, a lack of available shipping containers in places like China has slowed down supply chains, and the increased demand for containers has bid up their price to the point where some are being sent back empty, hampering U.S. exports.

Source: U.S. Bureau of Labor Statistics

At our recent Customer Service Council meetings, we heard a great deal from our customers about costs rising and tight availability on all kinds of items, including:

- Cardboard and boxes for packing and shipping

- Tractors, machinery and spare parts

- Trucks

- Fertilizer and lime

- Peat moss and other growing media

- Lumber, glass, steel and other building materials

- Animal feed and other ag commodities

- Plastics – sheeting, pots, crates, etc.

- Fuel and energy costs

Not only have many input costs risen, but tight supplies seriously limit the negotiating power of most producers as they scramble to get the materials they need for their businesses.

In addition, as spring begins to break and hiring ramps up, wages are higher for many types of workers, including workers on H-2A visas whose wages increased by 4-5% this year depending on the state’s Adverse Effect Wage Rate (AEWR). Minimum wages increased this year as well in most Northeast states. CDL truck drivers are particularly hard to find, according to many of our customers.

On the revenue side, the incidence and amount of price increases is more variable. Some Northeast producers have benefitted from being able to charge higher prices, but certainly not all. For many producers, the prices they receive have been stagnant, even as their costs rise sharply.

Consumers may see inflation increase later in 2021 as a result of these producer-level increases. Overall inflation, as measured by the Consumer Price Index, is expected to increase slightly, to about 2%, up from 1.6% in 2020. However, as with producers, consumers will see significant variability by type of expenditure. Gasoline prices, while remaining below 2019’s peak, increased by 6.6% in February, year-over-year. Housing costs have increased significantly as well — the National Association of Realtors forecasts annual median home prices to jump 8.0% in 2021.

Some factors that may mitigate some of these price increases for Northeast producers are food inflation and rising truck costs. Overall, the cost of food increased by 3.6% in February, year-over-year (of course, how much of that increase flows to the farm level will vary substantially by type of product). Rising trucking costs are a double-edged sword — while these increases will add to supply costs, they can also give Northeast producers with proximity to markets some competitive advantage over distant competitors: The rate for a full refrigerated tractor-trailer from California to New York is now averaging over $9,000.2 This gives Northeast producers at least a slight advantage over West Coast producers in terms of freight costs.

The gap between low consumer inflation and rising costs for agricultural producers puts many farms in a tough position — trying to pass on these rising costs in a market resistant to price increases. Meanwhile, raw material shortages, labor force disruptions and higher freight costs are squeezing profit margins.

So, what does the future hold? It’s likely that the current surge in business input costs will flow through to bring higher prices for consumers, and higher headline inflation. However, as supply chains begin to normalize, we should see price increases begin to taper somewhat. The Federal Reserve recently released projections that the U.S. economy will grow at its fastest pace in more than 40 years in 2021, and with that will come an increase in consumer prices. The Fed has increased its inflation outlook to 2.4%, a significant increase from its previous forecast of 1.8%. It expects inflation to slow to 2.0% in 2022. In the meantime, agricultural producers will have to pay higher prices for inputs, and hope that market prices for their products will keep pace.

1 J.P. Morgan/IHS Markit Global Manufacturing Report

2 USDA Agricultural Marketing Service

Editor: Chris Laughton

Contributors: Chris Laughton, Jeremy Forrett and Tom Cosgrove

View previous editions of the KEP

Farm Credit East Disclaimer: The information provided in this communication/newsletter is not intended to be investment, tax, or legal advice and should not be relied upon by recipients for such purposes. Farm Credit East does not make any representation or warranty regarding the content, and disclaims any responsibility for the information, materials, third-party opinions, and data included in this report. In no event will Farm Credit East be liable for any decision made or actions taken by any person or persons relying on the information contained in this report.

Tags: cost of production