June 3, 2020

Milk Market Situation and Outlook

Contents

Volume 14, Issue 6

June 2020

Click here for a PDF version of this month's issue.

Milk Market Situation and Outlook

Written by Christopher Wolf, Professor of Applied Economics and Policy, Dyson School of Applied Economics and Management, Cornell University

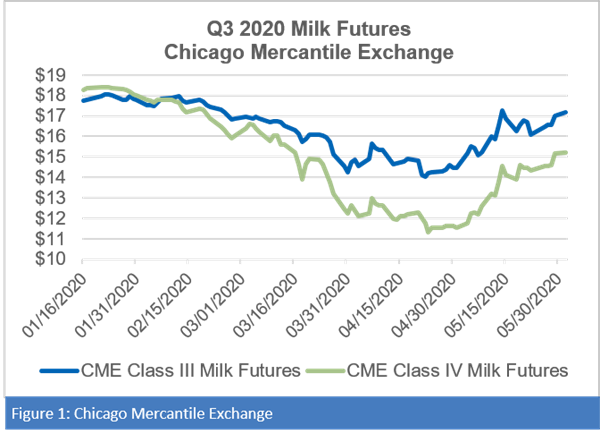

The national dairy market entered 2020 fairly balanced. Class III and IV milk futures were predicting average prices in the neighborhood of $18 per hundredweight. There was optimism that the international trade situation would improve from the situation of recent years, and the balancing in some regions was improving. Of course, we all know what happened in the past few months. The COVID-19 pandemic, which became a reality in the U.S. in March, resulted in a 30% or greater drop in milk prices and about a 10% drop in feed grain prices.

The price declines were the result of increasing concerns about demand affected by drops in employment, incomes and a dramatic decrease in institutional and restaurant sales. In recent years, Americans, on average, have spent more on eating away from home. In addition to spending, the products consumed tend to differ. When eating out, Americans tend to eat more dairy products — particularly cheese. With restaurant, food service and school closings, the away-from-home expenditures dried up.

With the unexpected and sudden change in consumption patterns and accompanying supply chain disruptions, a significant amount of milk was dumped, and more was sold at distressed prices. Unfortunately, dumping milk had become common during flush months in the Northeast region in recent years as the market looked for balance. Given the demand loss from the pandemic, a greater degree of market disruption was expected. However, April 2020 data from the Northeast Federal Milk Marketing Order were staggering. Previous high levels of dumped milk in the Northeast Order were around one percent of producer receipts, mostly attributed to declining class I milk sales. The April 2020 dumped milk share was 5.1% which amounts to about four million pounds of milk per day. One important note is that the dumped milk, while large, is only part of the market effect on farm milk prices. Prior to dumping milk, cooperatives and processors will work to find a home for the milk even if it is a distant location. In many cases, this milk is sold at what is referred to as “distressed” (heavily discounted) prices. These distressed milk sales are not directly measured in the market statistics but have put downward pressure on farm milk prices.

Both milk supply and demand are what economists refer to as “inelastic” meaning that a small change in quantity leads to a disproportionately large price response. This inelastic supply has had the effect of causing large farm-level milk price declines. Milk supply is generally slow to react to price changes but the cooperative base programs in some regions have contributed to a quicker response.

The government response to COVID-19 with respect to dairy has two parts: food purchase and donation and direct payments to farmers. The Food Box Program will purchase $3 billion in dairy products, meat and produce for donation to food banks and other non-profit organizations. This program both supplies food to needy families as well as replaces a portion of the demand that was lost in the pandemic. One important aspect of the program is that it aims to avoid building government stocks which have the potential to overhang the market and at least partially stifle a price recovery later.

The Coronavirus Food Assistance Program (CFAP) payments are intended to offset market losses caused by the pandemic. CFAP will offer direct payments of up to $250,000 per individual and a $750,000 maximum for farms with multiple owners. For milk production, a single payment will be made based on a producer’s certification of milk production for the first quarter of calendar year 2020 multiplied by $4.71/cwt. The second part of the payment is based on a national adjustment to each producer’s production in the first quarter multiplied by $1.47/cwt. The net result for milk payments will be $6.20/cwt on the first quarter milk production. Other relevant commodities include cull cows, corn, corn silage and hay. The intention is to pay 80% of the payment up front, and then assess how much of the total $16 billion in federal funding is still available before paying the remaining — and potentially pro-rated — 20%.

These programs are in addition to the Dairy Margin Coverage and Dairy Revenue Protection programs, both of which have payments that provide some risk management depending on the coverage level purchased by producers. As of this writing — May 25 — the markets have rebounded substantially for the remainder of 2020. This rebound is a product of the government food purchases and anticipation of re-opening the economy from the demand side as well as the milk supply cut-backs. However, it is clear that a great deal of uncertainty remains surrounding the milk market including the potential for a resurgence of the virus, potential for increased dairy product stocks, trade issues and international demand. As such, there is a continued need for dairy farmers to monitor operating costs and seek risk management solutions where they make sense with their farm financial and market situation.

Editor: Chris Laughton

Contributors: Christopher Wolf, Tom Cosgrove, Kyle Bell and Chris Laughton

View previous editions of the KEP

Farm Credit East Disclaimer: The information provided in this communication/newsletter is not intended to be investment, tax, or legal advice and should not be relied upon by recipients for such purposes. Farm Credit East does not make any representation or warranty regarding the content, and disclaims any responsibility for the information, materials, third-party opinions, and data included in this report. In no event will Farm Credit East be liable for any decision made or actions taken by any person or persons relying on the information contained in this report.