May 6, 2020

The U.S. Small Business Administration Opens Up Economic Injury Disaster Loans to Ag Businesses

Contents

Volume 14, Issue 5

May 2020

Click here for a PDF version of this month's issue.

The U.S. Small Business Administration Opens Up Economic Injury Disaster Loans to Ag Businesses

On May 4, the U.S. Small Business Administration (SBA) announced that ag businesses will now be eligible for SBA’s Economic Injury Disaster Loans (EIDL) and EIDL advance programs. Agricultural enterprises with 500 employees or fewer are eligible to participate.

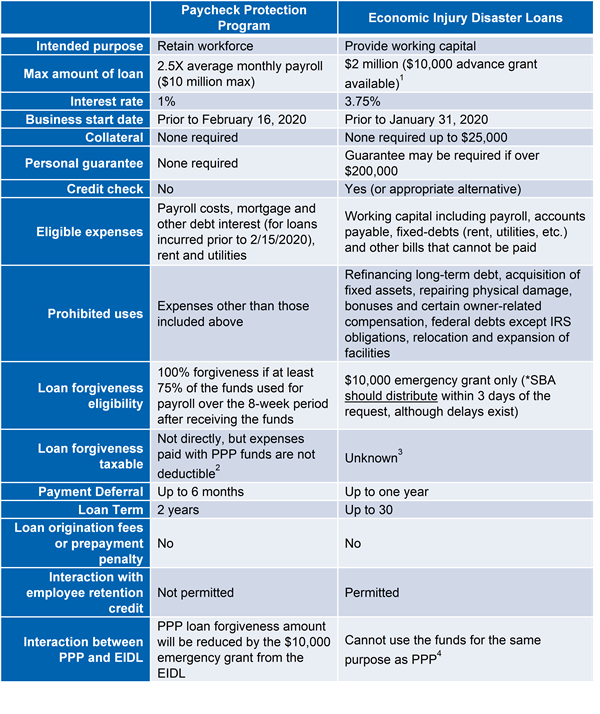

Historically, farmers have not been eligible for SBA programs since they are expected to apply for assistance through programs offered by the U.S. Department of Agriculture (USDA). A side-by-side comparison shows the benefits of these two programs; taxpayers are permitted to apply for both. Note that if a business receives both a Paycheck Protection Program (PPP) loan and an EIDL loan, the PPP loan forgiveness amount will be reduced by the $10,000 emergency grant from the EIDL and EIDL funds cannot be used for the same purpose as PPP funds.

Interested producers can apply directly through the SBA. Unlike the PPP, this is a more traditional loan, with guarantees and collateral required depending on the amount of the loan. Another unique aspect of this loan is that applicants don’t apply for a specific amount. The SBA determines the loan amount based on the financial information provided.

Up to $10,000 of the funds will be provided in an advance grant. The remainder of the funds must be repaid to the SBA at an interest rate of 3.75% for a term of up to 30 years.

Currently, the SBA is limiting EIDL applications to agricultural businesses only. Producers must apply directly with the SBA.

This article has been updated as of May 7, 2020.

1 The SBA has been limiting the $10,000 grant by allowing only $1,000 per employee on the books prior to January 31,2020. Thus, employers with under 10 employees during that time will likely receive less than the $10,000 max. Some members of Congress have been pushing the SBA to change that policy and allow the full $10,000 for all businesses, but as of press time, the policy has not changed. Due to high demand for the program, there are reports that SBA is limiting EIDL loans to $150,000.

2 The expenses (i.e. payroll) paid with forgivable funds are not tax-deductible which effectively makes the forgiven loan taxable (IRS Note 2020-32).

3 The $10,000 emergency grant is not required to be paid back even if the taxpayer is subsequently denied for an EIDL loan.

4 The SBA’s interim final rule for taxpayers who received an EIDL loan between 1/31/2020 and 4/3/2020 required the business to use the PPP loan (applied for after the EIDL loan) to refinance the EIDL loan if the EIDL was used for payroll costs.

Editor: Chris Laughton

Contributors: Dario Arezzo, Tom Cosgrove and Chris Laughton

View previous editions of the KEP

Farm Credit East Disclaimer: The information provided in this communication/newsletter is not intended to be investment, tax, or legal advice and should not be relied upon by recipients for such purposes. Farm Credit East does not make any representation or warranty regarding the content, and disclaims any responsibility for the information, materials, third-party opinions, and data included in this report. In no event will Farm Credit East be liable for any decision made or actions taken by any person or persons relying on the information contained in this report.