May 3, 2022

U.S. Maple Syrup Outlook

Contents

Volume 16, Issue 5

May 2022

U.S. Maple Syrup Outlook

This article is written by Mark Cannella, Extension Associate Professor at the University of Vermont.

The United States farm-gate value of maple syrup is ~ $150M annually. The industry is relatively small compared to other commodities but its ongoing expansion continues to have a positive economic impact on forested regions in the Northeast.

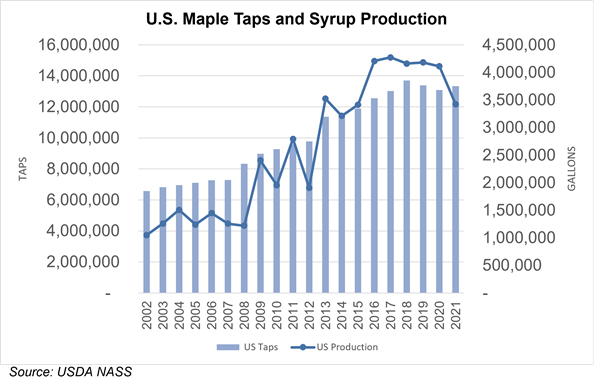

From 2007-2017, U.S. production and market expansion grew swiftly. The U.S. tap count, based on the USDA National Agricultural Statistics Service, stabilized near 14 million taps since 2018.1 Maple syrup production had held consistent at ~4.2 million gallons (46 M pounds) for two years until the 2021 maple crop came in far below expected levels.

In 2021, the total value of maple syrup sales in the U.S. was up 20% from the previous year. Canadian syrup exports were up 21% in 2021, driven mainly by demand in the United States but also demonstrating expanding markets in other hemispheres. Increased demand came from ongoing COVID-19 stay-at-home patterns that resulted in more cooking at home. Households also received financial support from government relief that has increased disposable incomes. Consumer patterns favor maple as well. National trends toward nutrition-conscious shopping and healthy eating aligns strongly with maple syrup’s image as a lightly processed, single ingredient, high quality sweetener. Maple is well positioned in the marketplace as an alternative to refined sugars and corn syrup. Strong demand and the short 2021 crop led to the Quebec Maple Syrup Producers (PPAQ) to utilize a substantial amount of syrup from the Strategic Reserve. Despite growing concern, PPAQ made announcements that there is no shortage, and the reserve has accomplished its goal to maintain an uninterrupted supply at stable prices.

In 2021 PPAQ announced the addition of 7 million new taps to their total tap quota. This expansion sends a signal that market growth is strong and that PPAQ will maintain dominance as the global leader in syrup production, currently producing 72% of global syrup. With this position, the PPAQ exerts price influence over the entire marketplace. The PPAQ previously agreed to a three-year price structure for syrup in effect through early 20232 and Canadian syrup imports (60% of U.S. consumption) drive syrup pricing. Bulk syrup buyers monitor U.S. — Canadian currency exchange trends and use the rates as an adjustment factor to keep U.S. prices on par with imports. PPAQ prices set a de facto price floor and imports into the U.S. keep higher prices in check, assuming there is no shortage of syrup. U.S. bulk producers got higher prices in 2021 but many were disappointed to recognize the stability offered by the PPAQ prevented a larger supply induced price increase. For direct marketers, 5% to 10% price increases were implemented by those with established brands and loyal customers to compensate for a poor crop.

Equipment manufacturers reported strong demand in 2021, a preview of more U.S. taps coming on line in 2022. Producers who deferred maintenance or expansion due to tight cash flow in 2021 will be waiting to see their 2022 yield and any price adjustments before they reinvest. Modern maple enterprises are capital intensive. Total assets, excluding real estate, generally total $55+ per tap. Positive cash flows are more likely if prices stay above $2.40 per pound. Another wave of U.S. tap expansion may occur if prices hold over the next two years.

Looking ahead to 2022:

- The 2022 domestic production season is wrapping up and reports from the field indicate at least average to above average production in the U.S. Maple harvest in northern regions and Quebec is still in progress (as of mid-April 2022).

- Delays on maple container shipments and other packaging show no sign of relief at the time of this report.

- The organic syrup category is expected to continue growing at a high rate and faster than conventional syrup.

- Expect increased marketing activity in other U.S. regions to avoid the tight competition in the Northeast.

- Bulk prices for conventional syrups were ~$2.40 - $2.50 (U.S.) per pound going into the 2022 season. As inventories shrank, and the 2022 crop was harvested there have been spot reports of stable or higher price offers from packers to secure inventory. Under average yields, prices are likely to hold or increase modestly. Major maple sellers consider modest increases to be feasible, but with caution that any dramatic price increase could discourage buyers and set back the overall long term market expansion.

- Larger operations (over 30,000 taps) will continue to expand when possible and this scale of production is expected to remain viable even when bulk prices dip to $2.00 per pound.

- Mid-scale operations (5,000 – 15,000 taps) find themselves potentially stuck in the middle with different paths if they cannot maintain high yields and break-even at $2.20 - $2.40 per pound syrup. Sap buying provides a strategy to increase total revenue, better utilize processing capacity and reduce overhead costs per unit. Mixed Marketing, where as little as 5-10% of the crop is sold, retail or wholesale, can often enhance revenues to reach profitability. Direct marketing requires significantly more labor expenses and marketing effort, but it can enhance revenue for the savvy entrepreneurs.

- Smaller syrup operations (less than 5,000 taps) are generally viable as a complementary enterprise. The seasonality of maple harvest is very compressed and must be integrated with other income over the full year. More intensive marketing plans for small maple operations are feasible, however the intensity of owner labor to secure direct markets must be balanced with the other non-maple income sources needed by the owners.

1 Industry experts suggest that there are more maple taps in operation than currently reported. The International Maple Syrup Institute and the USDA National Agricultural Statistics Service are currently working to improve the accuracy of maple statistics.

2 Quebec Maple Syrup Producers, News April 17, 2020. Available online at: https://ppaq.ca/en/communiques/bulk-maple-syrup-marketing-in-quebec/

Editor: Chris Laughton

Contributors: Mark Cannella, Tom Cosgrove and Chris Laughton

View previous editions of the KEP

Farm Credit East Disclaimer: The information provided in this communication/newsletter is not intended to be investment, tax, or legal advice and should not be relied upon by recipients for such purposes. Farm Credit East does not make any representation or warranty regarding the content, and disclaims any responsibility for the information, materials, third-party opinions, and data included in this report. In no event will Farm Credit East be liable for any decision made or actions taken by any person or persons relying on the information contained in this report.

Tags: maple syrup production