March 9, 2023

Scallops: The hidden driver of New England’s Fisheries Value

Written by John Sackton, founder of Seafood.com News, writer, market analyst, researcher and speaker specializing in the seafood industry.

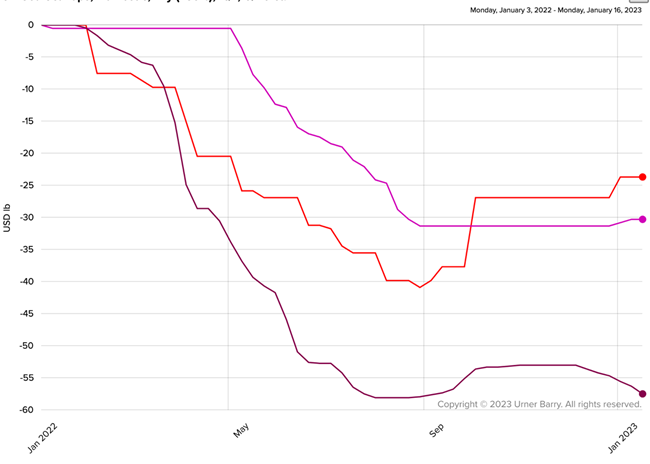

2022 was a terrible year for shellfish. Snow crab values plummeted 55%. Live lobster prices in New England are 30% lower at the end of January than they were the previous year. Lobster tail prices are also down 30%.

The one shellfish item that has not seen as dramatic a collapse in prices are scallops. Domestic scallops, primarily landed at the port of New Bedford, are down 24% from their price last January. More importantly, they are well above their price level in 2020 and 2021, something not true of lobster or crab.

Percent change in value of lobster, crab and scallop prices over the past year.

Source: Urner Barry Comtell

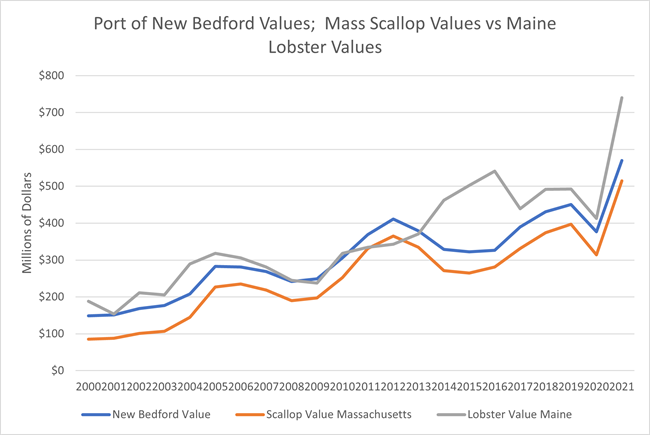

New England has two primary species that drive the value of its fisheries landings. One is lobster. The second is scallops.

Lobster is an iconic item, bound up with the experience of coastal Maine. It is recognized across the United States, and in China and Europe as well, as a premium luxury product. That means when difficulties hit the lobster industry, through export tariffs, price collapse or the most recent controversy over lobster gear impacts on right whales, it quickly becomes national news.

But Atlantic sea scallops contribute nearly as much as lobster to New England fisheries value. Lobster is normally the highest value fishery, but in the past five years, scallops have represented 75% to 80% of the lobster value.

Source: NOAA Fisheries Commercial Landings Data

Over the past twenty years, New Bedford has consistently had the highest landed value of any fishing port in the United States.

Sea scallops are a sought-after menu item at restaurants and have wide availability at retail. The success of the scallop industry is due to a unique level of cooperation between NOAA fisheries managers and scallop vessel companies that began in 1994, called rotational management.

In the early 1990’s scallop fishermen and NOAA were virtually at war over disagreements about the size and health of the scallop biomass. NOAA estimated scallop abundance based on its trawl surveys, and the fishermen felt they were grossly mischaracterizing the size of the resource.

Fishing time was severely limited and many vessels could not survive on the small number of days at sea they were given.

Scallops are unique in that they are processed by hand on board the fishing vessel. This means scallop vessels carry the largest crews of any fishing vessel in New England, generally 6 to 10 crew members. Scallops come aboard in the shell; the crew shucks the meats; loading them in the hold in 40 lb. bags. NOAA regulates the number of crew, which determines how much a vessel can catch.

An industry partnership with U. Mass Dartmouth developed a photographic survey method for scallops that was based on taking pictures of the bottom and counting the scallops in a particular area. After testing, NOAA accepted this method as scientifically accurate.

This allowed both NOAA and the industry to get a more precise idea of both the volume and size of scallops in the different fishing areas. The results speak for themselves.

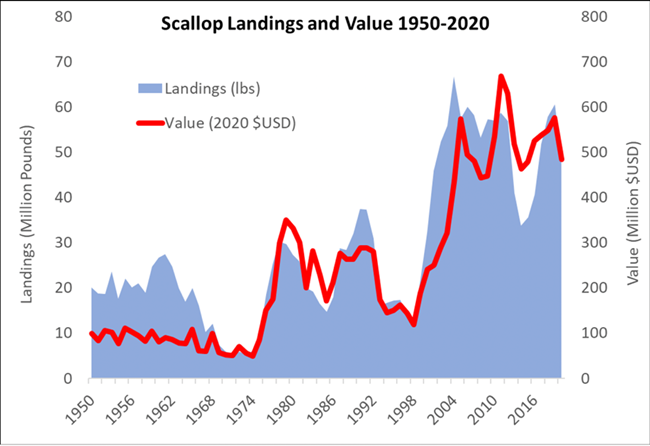

Source: NOAA Fisheries Evaluation of Rotational Management

After a period of decline between 1976 and 1994, once rotational management came into play, the volume and value of scallop landings soared as soon as the scallops in the closed areas had an opportunity to grow.

In 1994, NOAA approved a limited access program for scallops that identified scallop rotational fishing areas and allocated each license holder a specific number of pounds and trips into the designated areas each year.

Scallops are now managed with a ‘days at sea’ program for all New England and Mid-Atlantic waters outside of the specific scallop management areas. Days at sea is used to regulate the volume of landings and can vary from 20 to 50 or more. Using the days at sea program, there is no guarantee the vessel will find scallops or be successful. Whether they have good or poor landings, an 8- or 10-day scallop trip will count against that vessel’s total days at sea.

The closed areas are a different matter. There are three major areas. One is on Georges Bank, the other is called the Nantucket Lightship Area in the Great South Channel on the Western end of Georges Bank, and the third is off the Delmarva peninsula in the mid-Atlantic. The areas are fished on a rotational basis. It takes three to four years for scallops to grow to the largest size, and the rotation is to protect the younger scallops until they are ready to harvest.

Based on the biomass surveys, NOAA then assigns each license holder a certain number of trips to the closed areas with volume limits, such as two trips of 12,000 lbs each, or three trips of 15,000 lbs. Most closed areas will open on a three- or four-year cycle. In contrast to the ‘days at sea’ system, vessels fishing the closed areas know exactly what they will get, and fish until they have achieved their allocation for that trip.

NOAA also uses the rotational system to implement protections for by-catch species. The net effect is like farming the sea. Scallopers know how much their total quota will be from the closed areas, and how many less valuable days at sea they will be allocated. Then it is up to the vessel to determine the best time to fish their quota to obtain the best prices.

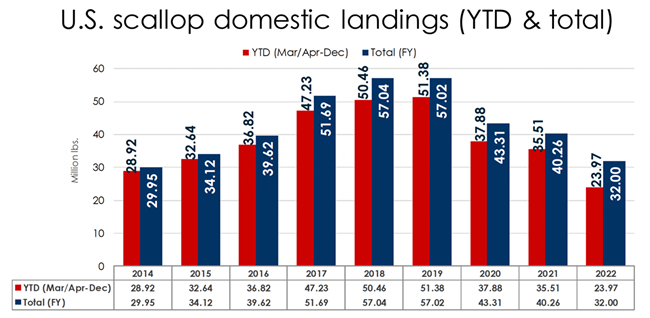

The scallop biomass naturally fluctuates. During a declining period, the number of trips and days at sea will be restricted, and during an increasing volume period, the number of closed area trips will be expanded. The result has been to stabilize the industry and to allow scallops to be marketed to the highest paying users.

Source: NOAA Fisheries Data and Urner Barry Publications

The stability of the scallop industry has attracted large investments into the sector. Several companies have consolidated large fleets of 20 or more vessels. Unlike traditional lobster fishing where the license requires the owner to set their own traps, the scallop industry uses hired captains and crews who work for the large, consolidated companies.

Scallops in New Bedford are sold based on an auction price, which is established daily and is sensitive to the volume and size of scallops being landed. Scallops from the vertically integrated companies not sold directly through the auction are still priced at the auction price for both captain and crew payments, and wholesale pricing to customers.

Scallops are indeed an overlooked New England economic success story.

WEBINAR - 2023 Fishing Industry Outlook

Recorded Thursday, April 13, at 12 p.m. ET

John Sackton, founder and publisher of Seafood.com News, provided an update on the current status of some key Northeast shellfish species, with a particular focus on the long-term success and sustainability of the scallop fishery.

Click here to view the webinar.

View additional 2023 Industry Trends & Outlooks

Farm Credit East Disclaimer: The information provided in this communication/newsletter is not intended to be investment, tax, or legal advice and should not be relied upon by recipients for such purposes. Farm Credit East does not make any representation or warranty regarding the content, and disclaims any responsibility for the information, materials, third-party opinions, and data included in this report. In no event will Farm Credit East be liable for any decision made or actions taken by any person or persons relying on the information contained in this report.