March 28, 2023

Written by Hans Walter-Peterson, Senior Viticulture Extension Specialist, Cornell Cooperative Extension

Wine and grape production is subject to the same whims and vagaries of the market and Mother Nature as the rest of agriculture. So often while one hand giveth, the other taketh away.

Such was the experience of many grape growers in much of the Northeast in 2021 and 2022. The winter of 2020-21 was kind to growers, with very little in the way of cold temperatures that could injure tender buds or entire vines. As a result, yields in 2021 were healthy for the most part, but cool and wet weather during the ripening phase of the year, combined with large crops, made it difficult to reach optimum quality standards in many cases.

The 2022 season was the complete opposite. Winter cold snaps and/or spring frost events lowered crop potential in parts of New York and Ohio, especially in the higher value vinifera cultivars where crop size was reduced by 50% or more in some varieties. Much of the Northeast and Midwest experienced drought conditions during the first few months of the season, which resulted in smaller berry size and reduced yields at the end of the season. But while yields were down, weather conditions were almost ideal to produce quality fruit in much of the Northeast. There is great excitement about the quality of the wines made from last year’s grapes – we just wish there was more of it.

Grape Prices up in 2022

The Finger Lakes Grape Program has been tracking grape prices in the region for over 20 years. The price trends observed during this period have depended on what kind of market growers were selling to. Bulk varieties like Concord and Catawba, which sell for around $300/ton on average, have seen slow but relatively steady increases in average value since 2000 (Figure 1). Demand for Concord grapes has increased significantly since 2020, resulting in a stronger market for that variety than has existed for some time. Catawba acreage has been decreasing over time due to a slow reduction in the number of buyers for the variety. Contracts have also been intermittent, with some processors determining their need for them on a year-by-year basis. Average prices for the grapes that have a market, however, have held steady.

Figure 1. Average prices for Concord and Catawba fruit as reported in the Finger Lakes Grape Price Listing, 2000-2022.

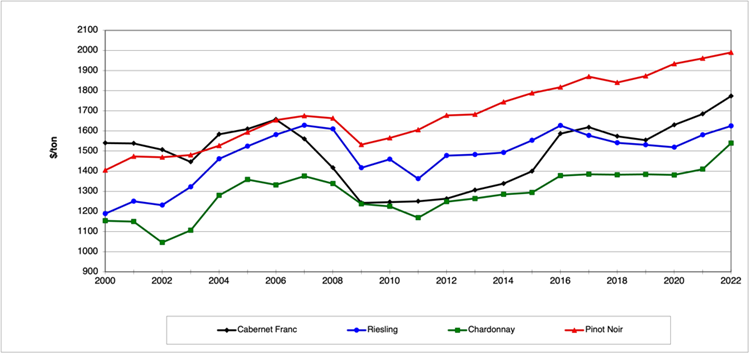

Figure 2. Average prices for selected V. vinifera varieties from the Finger Lakes Grape Price Listing, 2000-22.

Prices have been more dynamic for higher value vinifera varieties, as the region’s reputation for producing high-quality wines from them has grown in recent years, especially Riesling. Between 2008 and 2010, average prices for the region’s most important cultivars actually dropped as a large number of newly planted acres began to produce, resulting in a surplus of grapes on the market. Since that time, however, prices have slowly but steadily increased through the 2022 season by anywhere from 20 – 40% (Fig. 2). Unfortunately, these increases have not kept pace with the increases in input and labor costs, which is incentivizing growers to begin looking for new ways to reduce those costs while continuing to meet oncoming production challenges and produce quality crops.

Pest Challenges

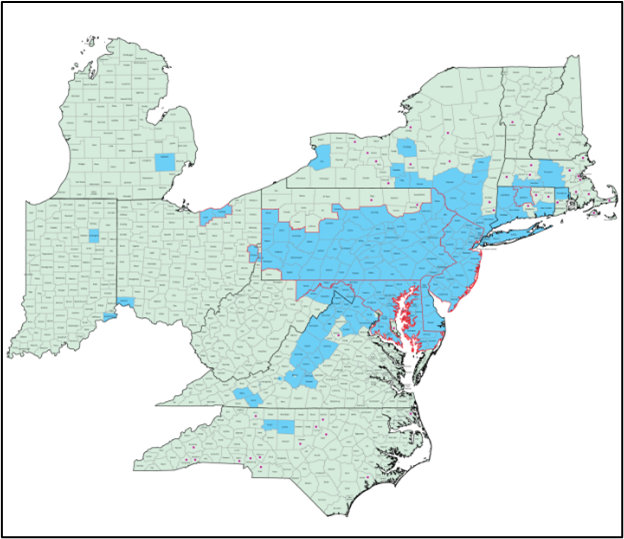

Fig. 3. Distribution of established populations of SLF as of March 14, 2023. Source: NYS IPM Program

The Spotted Lantern Fly (SLF) is an invasive pest that first appeared in southeastern Pennsylvania in 2014. It has quickly spread in the mid-Atlantic and Northeastern U.S. and is now established in portions of 14 states (Fig. 3). One of the preferred hosts for SLF is grapevines, and evidence from Pennsylvania has shown that they can have a major impact on the survival and productivity of vineyards in areas where the insect has become well established. The first population of SLF was confirmed in a vineyard in the Hudson Valley in 2022 but given their proximity to other major production areas in the state, it is only a matter of time before they become established in other grape growing regions in New York.

Spotted Lantern Fly adults feeding on a grapevine prior to harvest. Source: Penn State University

Multiple Northeast research institutions have been coordinating research and extension activities to help growers to manage this new pest. While it is too early to predict the exact impact of this invasive pest on vineyard and wine production in New York and elsewhere, there is growing optimism about the ability to manage these pests when they appear to prevent them from causing major economic losses to grape growers.

Digital Ag: Coming to a vineyard near you

For many years, agricultural producers have been adopting technologies that help to improve farm efficiency and reduce labor inputs. Apart from mechanical grape harvesters, the U.S. grape industry has been relatively slow to adopt some of this new technology compared to other commodities. That is starting to change as the costs of production keep increasing while the labor force that is willing to work in vineyards shrinks dramatically.

Digital agriculture technologies that have been relatively commonplace in other crops are beginning to make their way into the U.S. grape industry, with much of this work being led by faculty and extension staff at Cornell University. The ability to spatially map yields, canopy growth, disease development and other important parameters in vineyard production provides growers with more detailed information about where to focus their management resources to maximize production and quality goals in their vineyards.

In addition to providing better information about vineyard issues, these technologies are also driving new innovations in automation and mechanization in the vineyard, which will help to make up for losses in vineyard labor. For example, scans by inexpensive canopy sensors can be used early in the season to drive automated mechanical thinners that can selectively reduce the number of shoots on a vine depending on the number of buds that emerge in a given season, which promotes airflow and sun exposure to the leaves and clusters. Remote sensors on drones or satellites can detect disease development in a vineyard before it becomes visible to the human eye, allowing growers to proactively manage them before they become more significant and difficult to control.

Conclusion

As with the rest of agriculture, the Northeast wine/grape industry is facing significant challenges in the coming years in the form of changing climatic conditions, new invasive pests, and an uncertain labor market, just to name a few. In this kind of environment, the key for growers to not just survive, but thrive, is to be willing to adapt their vineyard operations to incorporate new ideas and technologies that allow them to continue to grow quality grapes with fewer inputs.

Note: The full Finger Lakes Grape Price list for 2022 is available for viewing at https://blogs.cornell.edu/flxgrapes/2022/09/21/finger-lakes-grape-prices-2022/.

|

Hans Walter-Peterson is a Senior Viticulture Extension Specialist and Team Leader for the Finger Lakes Grape Program with Cornell Cooperative Extension. He holds a Bachelor of Arts from St. Olaf College and a Master of Science from University of California – Davis. His outreach and research program covers a wide range of topics related to vineyard management. |

View additional 2023 Industry Trends & Outlooks

Farm Credit East Disclaimer: The information provided in this communication/newsletter is not intended to be investment, tax, or legal advice and should not be relied upon by recipients for such purposes. Farm Credit East does not make any representation or warranty regarding the content, and disclaims any responsibility for the information, materials, third-party opinions, and data included in this report. In no event will Farm Credit East be liable for any decision made or actions taken by any person or persons relying on the information contained in this report.