September 2, 2020

USDA’s Farm Service Agency (FSA) has recently made two changes regarding eligibility for USDA programs (See Notice PL-290 [USDA FSA Handbook] and 85 FR 52033 [Federal Register notice]). This Tax Talks blog entry is the first of two that will discuss those eligibility changes. Today’s entry focuses on the evolution of and recent changes to USDA benefit limits based on Adjusted Gross Income (AGI). The next blog will discuss the impact on program payments of new entity rules based on changes in the 2018 Farm Bill.

Evolution of AGI Qualifications

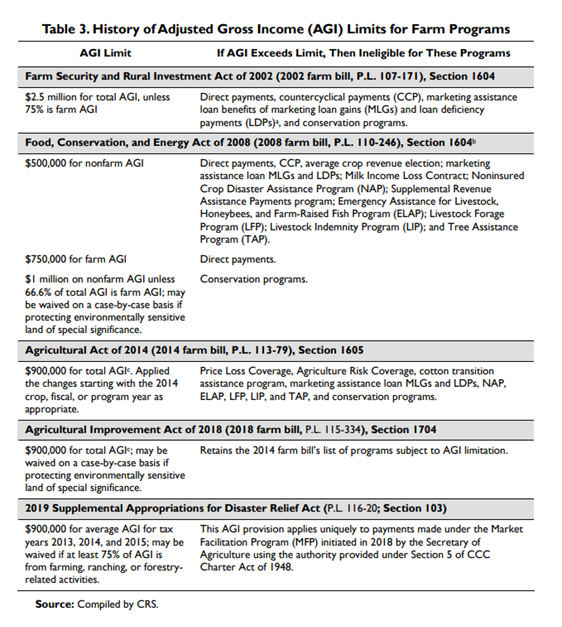

Congress first included an AGI limitation on farm program payments in the 2002 Farm Bill and has made several adjustments in recent farm bills. Below is a history of AGI limits for farm program payments that was compiled by the Congressional Research Service.

When reviewing whether or not AGI limitations are applicable, the rules generally look to the last three taxable years preceding the most immediately preceding complete taxable year with an exception noted in the chart above for Market Facilitation Payments (MFP).

Change to AGI Qualifications in USDA FSA Handbook Notice PL-290

Historically, income from wages or dividends received from a legal entity were not considered farm income, but that has changed with the most recent update of the USDA 5-PL handbook for payment eligibility, payment limitation and adjusted gross income.

Since corporate businesses provide wages and dividends, the rules have been updated to include them, meaning that wages and dividends from the following types of entities now need to be included in determining whether or not AGI limitations for farm program payments apply. This change is applicable for program year 2020 and subsequent years. These rules apply to:

- An Interest Charge Domestic International Sales Corporation (IC-DISC) materially participating in the farming, ranching or forestry activity where the dividend is derived from farming, ranching or forestry.

- A “closely held” legal entity materially participating in a farming, ranching or forestry activity, defined as owned (directly or indirectly) by five or fewer individuals holding more than 50% ownership interest.

- A legal entity comprised entirely of family members (as indicated in 5-PL, paragraph 213), when the legal entity is materially participating in farming, ranching or forestry.

In this context, materially participating is defined as more than 50% of the legal entity’s gross receipts (for each tax year in the 3-year period used to complete the average farm AGI) derived from farming, ranching or forestry sources. It is important to note that materially participating in this context is much different than taxpayers determining material participation for items such as self-employment tax and the passive activity rules.

Conclusion

As the rules continue to get more complex, it is more important than ever that farm advisors be well versed in not only federal and state income and estate taxes, but also how planning strategies and entity formation may impact farm program payments.