October 6, 2020

2020 is shaping up to be a potentially high-income year for some farmers across the country, especially given the latest round of Coronavirus Food Assistance Program (CFAP) payments. One tool that will likely come into play for fruit growers this year is the ability to depreciate 100% of the cost of new orchards.

Most farmers are familiar with the uniform capitalization rules (UCR). Typically, when orchards are acquired before the trees have reached an income-producing level, the pre-productive costs must be capitalized. But, a farmer may choose to elect out of the rules at the cost of a slower depreciation method known as the alternative depreciation system (ADS). Under ADS, depreciation on the trees begins when they reach an income producing phase that makes commercial sense to harvest.

Since the PATH Act of 2015, the good news is that most farming businesses with annual gross receipts of $26 million or less for the three preceding tax years are not subject to the uniform capitalization rules.1 In other words, those pre-productive costs, such as fertilizer and labor, can be immediately expensed for these farmers.

As mentioned above, even if a grower is not subject to UCR, the trees are not typically depreciable until they become commercially viable. However, prior to January 1, 2023, fruit growers are eligible to claim 100% special depreciation allowance (SDA) on the cost of their plantings. 2020 may be the year that it makes sense to take advantage of this tool. For example, if a farmer planted $500,000 of orchards in 2020, the planting can be 100% depreciated. From a multi-year perspective, this tool is available until 2026, although it begins to phase out in 2023 as the chart below indicates.

It is important to keep in mind that many states do not follow the federal rules on SDA and thus prudent tax planning at the state level must also be considered.

Taking a look at an example to illustrate SDA, let’s assume the costs of high-density orchards are $100,000 in year one. Years one and two have pre-productive expenses of $20,000 and $30,000. Below are some of the options available to this farmer.

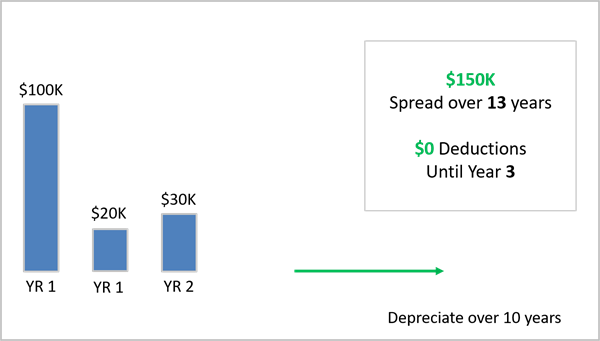

Option 1: A cash basis farmer subject to the UCR chooses not to elect out. They also choose to not take advantage of 100% SDA on the $100,000 of trees. The $150,000 of expenses would start being utilized in year three, at commercial viability, over a 10-year period.2

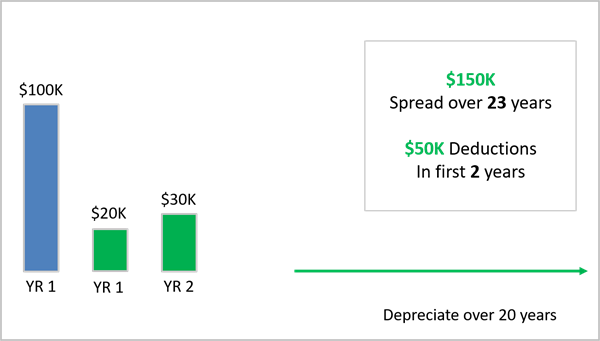

Option 2: A cash basis farmer subject to the UCR decides to elect out. They also choose to not take advantage of 100% SDA on the trees. The $50,000 of pre-productive costs are expensed when incurred. The plantings, on the other hand, are depreciated over a 20-year period beginning in year three because the fruit grower is now subject to a slower depreciation method known as ADS, which depreciates the orchard over a 20-year period.

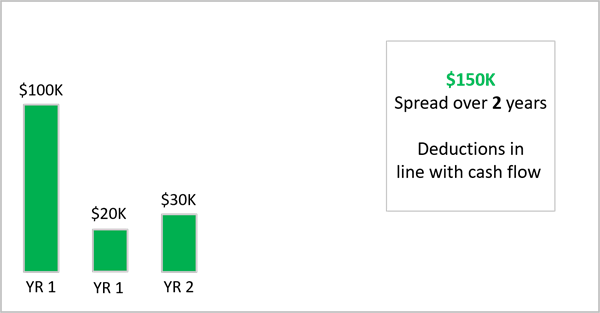

Option 3: A cash basis farmer subject to the UCR decides to elect out and to also take advantage of 100% SDA. All expenses are deducted when incurred. Like option 2, the farmer would be subjecting the farm to ADS.

Farmers should take a multi-year approach to tax planning in 2020, utilizing tools like SDA in a manner that makes sense for the long term.

1 There are exceptions for farms defined as tax shelters under the rules.

2 In year 3, they could choose to take regular SDA. Examples assume half-year convention.