September 15, 2020

Let’s start with some background. Generally speaking, only farmers who are “actively engaged in farming” (AEF) are eligible to receive certain farm program payments. This requirement has two components to it: a contribution of assets component and a contribution of labor (and management) component. The FSA is finally updating rules that were required from the 2018 Farm Bill.

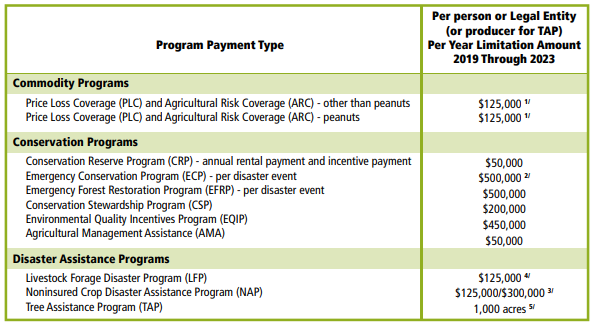

Below is a summary of the annual payment limitations, compiled by the FSA, for a person or legal entity for programs that are subject to the 2018 Farm Bill limitations.

Note: Market Facilitation Program (MFP) payments are also capped per person or legal entity at $125,000.

Getting back to the AEF requirement, being AEF for an individual means:

- The person, independently and separately, makes a makes a significant contribution to the farming operation of (a) capital, equipment, or land; and (b) active personal labor, active personal management, or a combination of active personal labor and management.

- The person’s share of profits or losses is commensurate with his/her contribution to the farming operation.

- The person shares in the risk of loss from the farming operation.

Family farms (not a corporation or an LLC), have a special rule where every adult is deemed to meet these requirements. This is good news here in the Northeast as there is a significant concentration of family farms. Remember also, since the 2018 farm bill that in addition to lineal family relationships, siblings and spouses this includes first cousins, nieces and nephews. There is also a special spousal rule, where is one spouse is actively engaged, the other is deemed to be as well (similar to tax rules regarding passive activities).

There are also different rules for general partnerships (and joint ventures) where members are treated separately in determining whether they the above tests. Similarly, corporate (and LLC) requirements mandate that in addition to meeting the individual AEF criteria above for profit and risk sharing, that each owner make a significant contribution of personal labor or active management (regardless of compensation) that is (a) performed on a regular basis, (b) identifiable and documentable, and (c) separate and distinct from contributions of other stockholders or members.

The chart below summarizes payment limitations based on the entity.

|

Entity |

Payment Limitation1 |

|

Sole Proprietors and General Partnerships consisting of family members - Family Farms (non-LLCs, Corporations) |

Special treatment where every adult member meets the AEF test and is potentially eligible to receive payments up to the individual limit. |

|

Non-Family General Partnerships |

Equal to the limit for a single person times the number of persons or legal entities that comprise the ownership of the joint operation plus any additional exemptions or exceptions. Adding a new member can provide one or two (with qualifying spouse) additional payment limits. |

|

Corporations (LLCS, LLP, LP, S- and C-corps)2 |

Treated as a single person for determining eligibility and payment limitations. Adding a new member to the corporation generally does not affect the payment limit but only increases the number of members that can share a single payment limit. |

To provide a little more context into that “(1)(a) capital, equipment, land” requirement, take a look at the following chart.

|

Item |

Rule (Summarized) |

|

Capital |

Value equal to least 50% of the individual’s (entity) share of total capital for the farm. |

|

Equipment |

Theoretical rental value equal to at least 50% of the individual’s (entity) share of total rental value of equipment necessary for the farm. |

|

Land |

Theoretical rental value equal to at least 50% of the individual’s (entity) share of rental value of land necessary for the farm. |

|

Combination of the above |

Value equal to 30% of the individual (entity’s) commensurate share. |

|

Item |

Rule |

New Rule |

|

Active Personal Labor |

Lesser of (a) 1,000 hours or 50% of the total hours required. |

|

|

Active Personal Management |

Critical to the profitability of the farming operation. |

Performing activities on a regular, continuous and substantial basis and either (a) performs annually at least 25% of the total management hours, or (b) performs at least 500 hours of management annually. |

|

Combination of the Above |

Must have a critical impact on profitability equal to the significant contribution of either consideration taken alone. |

|

Observation

For tax advisors used to navigating the passive activity rules (i.e. rules that allow taxpayers to deduct losses), this “regular, continuous and substantial” standard seems very familiar. The Congressional Research Service has noted that this change in active personal management has been done intentionally in order to reduce payments to those passive investors who were not actively contributing to the farming operation. As a result, “a limit is placed on the number of nonfamily members of a farming operation who can qualify as a farm manager . . . [but] no such limit applies to the potential number of qualifying family members.”3

Conclusion

Maximizing farm program payments is one of many considerations in properly structuring farming entities. Farmers should work closely with their trusted advisors to ensure that the business is set up for long-term success.