Who We Are

Made in Agriculture

Who We Serve

How We Operate

Along with a share of voice, our customer-owners may get a share of our net returns in the form of a patronage payment based on their financing with us.

What We Offer

Commitment to Northeast Rural Communities

Build Connections. Build Relationships. Build Community.

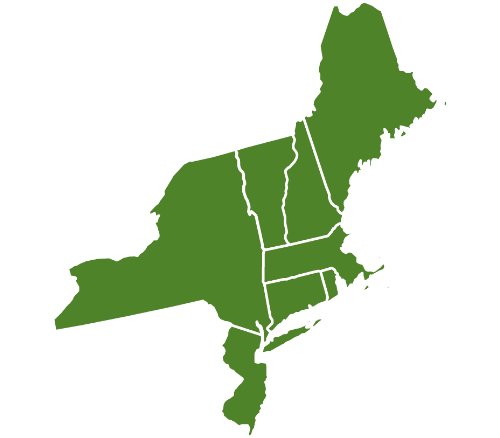

Where We Are Located

FAQs

Farm Credit East is a mission-driven, customer-owned, ag financial cooperative. We are dedicated to serving the financial needs of Northeast agriculture.

Our products and services are focused on saving our customers money. Plus, our customer-owners receive a share of our net earnings not needed to operate or capitalize the business. Learn more about our patronage dividend program.

Additionally, Farm Credit East is governed by a member-elected Board of Directors. Board candidates are selected by the Association Nominating Committee, who represent each branch office across the Association territory, and then all voting stockholders have the opportunity to vote in the annual Director elections. This ensures the Board of Directors represent the customers and industries Farm Credit East serves. Learn more about the Board of Directors.

Farm Credit raises funds by selling debt securities on the nation's money markets through the Federal Farm Credit Banks Funding Corporation. Farm Credit debt is insured through the Farm Credit System Insurance Corporation, a self-funded insurance entity.

Neither. Unlike commercial banks and other lenders, Farm Credit East is not a depository institution. We are owned by our customers. This cooperative structure is your best assurance that competitively priced credit will always be available to farmers, fishermen, forest products producers and other agricultural businesses.

Cooperatives are structured so that customers are stockholders and entitled to share in the earnings of the organization. Patronage dividends are a major advantage when you borrow from Farm Credit East. Being a cooperative also means that we are led by a member-elected Board of Directors.

It depends on the services that you wish to use. For credit services, you must buy stock and therefore become a member. We provide financial services for anyone involved in an agricultural business, including owners, managers, employees and part-time farmers as well as agricultural processing and marketing businesses. Agricultural cooperatives borrow from Farm Credit through our affiliated lending institution, CoBank.

We have a number of programs to help support talented, hardworking individuals enter agriculture. Helping young people get started in farming is one of our long-term commitments to Northeast agriculture. Programs include our young and beginning farmer incentives, FarmStart and GenerationNext.

“Farm Credit East is a true partner and ahead of the curve as a lender. Their representatives are facilitators, not road blockers. Credit availability tied to competitive interest rates, crop insurance and regular patronage refunds have positively impacted our business. We could not have carried out many of our projects with any other lender.”

Jeff Crist

Crist Bros. Orchards

Walden, New York

Views From the Field

“Farm Credit East is a true partner.”

The Crists came to Farm Credit East to expand their business after increasing the volume of their apple production and missing key sales dates due to breakdowns and other holdups. The family’s solution was to replace their out-of-date packinghouse with a state-of-the art facility that would make them more competitive and efficient. Knowing that swings in agricultural markets would make financing hard to obtain from a commercial lender, they turned to Farm Credit East.

Farm Credit East was instrumental in funding an expansion that better prepared them to profit from key agricultural cycles. Their Farm Credit East loan officer’s understanding of the Crists’ business and industry needs helped shepherd the loan through to meet their specific needs.