February 13, 2023

Written by Dr. Christopher A. Wolf, E.V. Baker Professor of Agricultural Economics, Cornell University, Charles H. Dyson School of Applied Economics and Management.

2022 Review

By far the biggest economic story of 2022 was inflation — particularly with respect to energy, food and housing — which averaged about 8%. In response, the Federal Reserve raised the federal funds rate seven times in 2022, with more likely on the way in 2023. Long-term farm debt may be largely locked in at the previous lower interest rates, but new or operating debt will be more expensive for the foreseeable future.

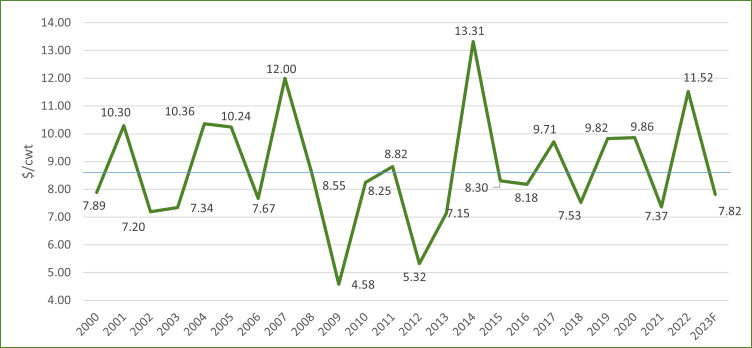

The U.S. all milk price hit a record (nominal) high of $27.30/cwt. in May and finished at an average of $25.55/cwt. The income over feed cost margin is a proxy for dairy farm profitability as well as the trigger for Dairy Margin Coverage payments. The average IOFC from 2000 through 2022 was $8.75/cwt. (see figure). Historically, about three-quarters of the variation in IOFC has been driven by the milk price.

From Figure 1, it is clear that 2007, 2014 and 2022 were profitable years, while 2009 and 2012 resulted in large losses. There is a tendency for margins to move back toward the average value as milk production and consumption react to demand or supply shocks, but over-shooting high and low is the norm.

Figure 1. US Income Over Feed Cost Margins, 2000-2022

Nationally, the U.S. finished 2022 with 9.4 million milk cows, which was 67,000 more than the end of 2021. 2022 milk production trailed 2021 by 0.7% through the first six months but finished the year up +0.2% — essentially flat — based on 1.1% growth year-over-year in the second half of 2022. The growth to finish the year provides a degree of momentum entering 2023.

However, milk production growth was not uniform, with Texas and South Dakota having particularly large increases. Other parts of the country, including the northeast and California, responded less to the higher margins. This reflected several factors, including that the margins themselves were less indicative of profit than in the past given increases in energy and labor costs.

Feed cost increases were not uniform with California in particular dealing with high forage costs due to drought. Another factor is the base programs which were estimated to affect 50% of U.S. milk production in 2022.

Internationally, milk production shrank year over year in New Zealand, Australia and the European Union which presented opportunity for U.S. dairy exports to fill the gaps. Higher product prices also contributed to increased export revenue for U.S. dairy products. The result was U.S. dairy exports increased by 25% in value over 2021 levels through November although quantity of exports increased only 5%.

2023 Outlook

Uncertainty abounds for 2023. At the time of writing, 2023 dairy product and farm milk prices have been trending downward from their lofty 2022 levels. Milk production is forecast to increase slightly in 2023 following the generally profitable prior year. The northeast is likely to continue to lag other regions in milk production growth as base programs cap desired farm-level increases. On the demand side, the key factors for 2023 include the general economy for domestic demand. On the international side, China is key for dairy markets.

Economic pundits in the U.S. are making a full-time job out of predicting whether and when a recession might hit the U.S. Many leading indicators suggest a recession is pending as the Federal Reserve endeavors for a soft landing from inflation. A recession would impact demand through reduced consumer income and resulting purchasing power. The effects of any recession on farm milk price are likely to depend very much on where and for what product the milk is utilized. Past research suggests that eating away from home declined by 13% during the 2007-09 time period but bear in mind that was a particularly deep recession. Still, the COVID experience sharpened insights into how differently U.S. consumers dairy product eating habits are at home (more beverage milk, cream cheese, yogurt) compared to eating out (more cheese, less beverage milk).

The Chinese economy seems to be in a fragile position at the current time. One factor is the removal of the zero-COVID policy which has resulted in widespread infection and resulting difficulties. China was already dealing with economic headwinds including a large housing bubble. While Mexico and Canada are more reliable trade destinations, China is important to the U.S. dairy industry because Chinese purchases of U.S. dairy products have been correlated with high farm milk price years. In both 2014 and 2022, dairy exports to China were key to high international dairy product prices. China has increased milk production in recent years and produces almost all its fluid milk needs but is heavily reliant on imports for cheese, butter and milk powders. 2023 dairy imports into China are currently forecasted to be similar in terms of volume but higher prices and weak economic forecasts might lower that value.

On the dairy supply side, stocks, input prices and weather loom large. Recent cold storage reports indicate that stocks of butter and cheese were increasing cap milk prices in 2023. Ramped up production in the second half of 2022 has stretched processing capacity in some regions, while labor issues continue to plague farms, haulers and processors. Added cheese production capacity means that exports will need to grow to balance that market in the coming years. With U.S. powder product and cheese prices competitive internationally, exports are likely to continue to expand depending on international demand.

Environmental policies in New Zealand and the EU may also damper supply response internationally. For example, the Netherlands aims to cut nitrogen emissions by 50% by 2030. With 1.6 million dairy cows, they are a major milk producer but will likely have to cut cow numbers by as much as 30% to meet the stated goals. However, farm profit margins were high in those countries to finish 2022, which encourages growth.

USDA is forecasting 2023 all milk price at $21.60/cwt. which is almost $4/cwt. below the 2022 all milk price of $25.55/cwt. At the same time, USDA is forecasting corn and soybean prices to remain near their 2022 values of $6.70/bu and $14.20/bu, respectively. Futures markets at the current time are consistent with the USDA forecast for milk price but expecting lower corn prices — closer to $6/bu — perhaps because energy and fuel prices have recently moderated. Feed prices in particular will be affected by global weather in 2023. The recent decline in fuel prices bodes well for fertilizer prices and acreage planted in the U.S. — but was it too late to help for 2023?

The first six months of 2023 are forecasted to continue La Nina Pacific Ocean currents which generally means drought in South America and the Southwest U.S. as well as wetter weather in the corn belt and northeast. However, models are increasingly forecasting a weakening of that current in the second half of 2023. If the currents change in the middle of the year, it could impact 2023 yield and resulting harvest.

Using the above values, the current 2023 forecast is $7.87/cwt., which would be a below average year (see figure). Futures markets are efficient and unbiased estimators of milk and feed cost, but notoriously bad at predicting both supply and demand shocks. In particular, the supply factors discussed here will determine whether this forecast holds.

Policy Outlook

The current farm bill expires at the end of 2023, meaning discussions will ramp up this year resulting in either a new bill or an extension of the current legislation. While about 70% of farm bill spending is for nutrition programs, there are several important agricultural commodity programs and dairy related issues. The Dairy Margin Coverage program may be revisited as far as production history, Tier 1 limits and margin levels. The increasing cost of labor and energy certainly indicate that margins do not indicate the profits levels they once did. Dairy farms will also be interested in environmental programs which may enable and encourage investment in carbon capture technology.

Finally, it is likely that there will be movement on a Federal Milk Marketing Order hearing of some sort in the next year. Dairy farms and cooperatives from all regions seem to agree that Class I pricing and make allowances are in need of examination. Other potential topics include pooling rules and price discovery aspects. The northeast perspective and voice will be important to arrive at an agreeable result.

Dairy Market Webinar

Farm Credit East and Dr. Chris Wolf, Cornell University, reviewed dairy markets in 2022, and provided an outlook for 2023.

For more information and to view the webinar click here.

View additional 2023 Industry Trends & Outlooks

Farm Credit East Disclaimer: The information provided in this communication/newsletter is not intended to be investment, tax, or legal advice and should not be relied upon by recipients for such purposes. Farm Credit East does not make any representation or warranty regarding the content, and disclaims any responsibility for the information, materials, third-party opinions, and data included in this report. In no event will Farm Credit East be liable for any decision made or actions taken by any person or persons relying on the information contained in this report.