November 4, 2025

Key Updates to H-2A Adverse Effect Wage Rates for Northeast Agricultural Employers

By: Austin Weaver

A new interim final rule (IFR) for H-2A guestworker Adverse Effect Wage Rates (AEWRs) was issued by the Department of Labor (DOL) and posted to the Federal Register on October 2, 2025. AEWRs are the minimum hourly wage rates that must be offered and paid by employers to H-2A workers and workers in corresponding employment. This IFR makes significant changes to how wages are calculated for farm laborers across Farm Credit East’s 8-state territory. Below is a summary of the key provisions of this new rule and the implications it has for Northeast farm operations:

- Revised AEWR Calculation Methodology

The new rule implements a state-specific approach to calculating the AEWR based on state-level wage data from the Bureau of Labor Statistics’ Occupational Employment and Wage Statistics. Previously, the AEWR was set for a multi-state region and utilized wage data from the Farm Labor Survey.

- Skill-Based Wage Levels

Two distinct wage levels are introduced: Skill Level I and Skill Level II. Each contract will be assigned a skill level based on the determination factors listed below:

Skill Level I:

- No formal education or training required

- 0-2 months of work experience necessary or several weeks of on-the-job training required

- Instructions given from a supervisor

- Work “closely monitored, racked and assessed for quality, accuracy and production results”

Skill Level II:

- 3+ months work experience required

- Demonstration of how to perform the job is not generally required

- May be assigned more complex tasks

- Work may not be as closely monitored

Employers will need to pay close attention to the language used in job descriptions for H-2A job orders to properly classify the skill level for each contract. The determination of a Skill Level for a job order is based on the minimum qualifications necessary to perform a job, not on the experience of the actual employee(s) that fill the job order.

- Required Wage Rates

Employers must pay the higher of the following wage rates to H-2A Workers:

- The AEWR, or the minimum hourly wage rates that must be offered and paid by employers to H-2A workers and workers in corresponding employment.

- The Wage Rate listed in the Certified Job Order, or the minimum wage an employer must pay for the job listed as determined by the U.S. Department of Labor or state agency

- Other Applicable Wage Rates, such as federal or state minimum wage, prevailing wage rates, or the agreed-upon collective bargaining wage.

- Housing Adjustments

While employers of H-2A employees are required to provide housing at no cost to the H-2A employees, many domestic workers often pay for their own housing. As such, H-2A workers tend to retain more of their income than domestic workers who must spend additional income on living expenses while earning the same wage. The new rule compensates for this difference by allowing a state-level downward compensation adjustment for H-2A workers, allowing employers to subtract a specified amount from the required wage rate.

- Effective Date and Compliance

These new wage rates became effective as of October 2, 2025, when the IFR was posted to the Federal Register. Employers must continue to follow wage rates specified in currently certified job orders if they are higher than the newly published AEWR.

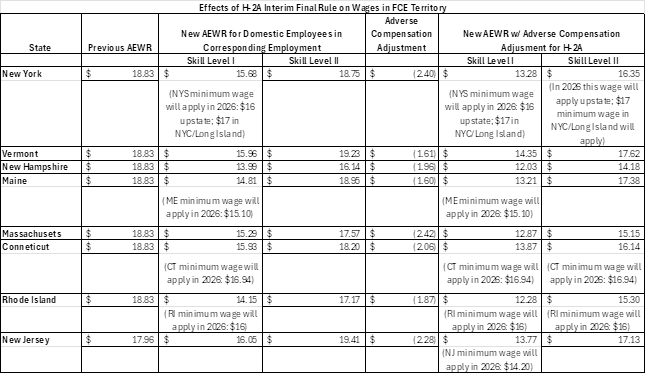

The table below shows the combined AEWR schedule for the five most common field and livestock worker Standard Occupational Classification codes for the 8-state territory served by Farm Credit East.

Example:

Consider 2 employees, an H-2A employee and a domestic employee, both performing a Skill Level I job at a farm in New York State. Under the previous rules, both were paid the AEWR of $18.83/hr because they were performing the same work in an operation that employed H-2A and domestic workers.

Under this new rule, the AEWR calculation is different for each because of the Adverse Compensation Adjustment for the H-2A workers employer provided housing. However, as of January 1, 2026, both AEWR rates ($15.68 for domestic; $13.28 for H-2A) will fall below the state minimum wage of $16/hr for upstate counties. The rule requires that the higher of AEWR or state minimum wage be paid, so both employees would be required to receive a minimum of $16/hr, which is below the current AEWR but exceeds the revised AEWR calculations.

With the DOL’s Interim Final Rule in effect currently, H-2A applicants will need to pay careful attention to these changes as the start of new job order filings approach. Any new developments from the DOL or litigation around the IFR will need to be carefully monitored and consideration given to state minimum wage increases set to take effect in 2026 and coming years.