April 21, 2020

The COVID-19 outbreak has turned our everyday lives into a world of unknowns. In response to the pandemic, several federal and local laws have been passed to attempt to help workers and businesses being affected.

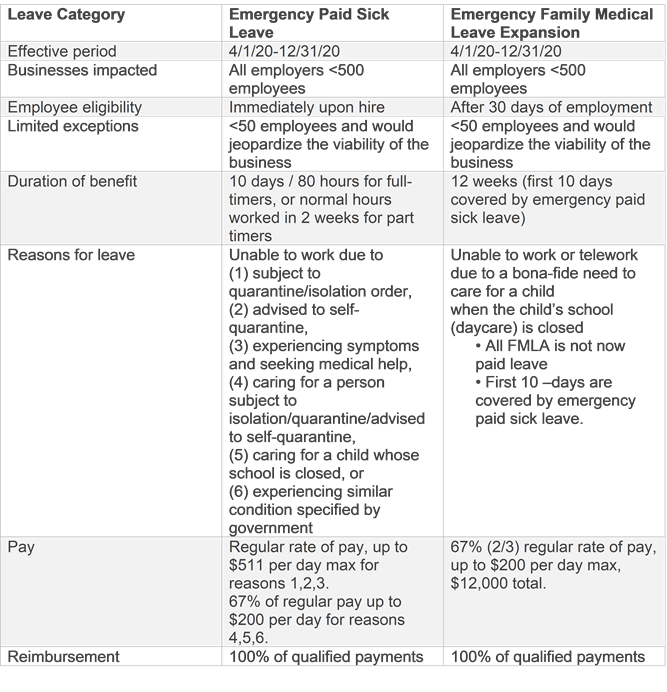

The most significant payroll legislation passed as a result of COVID-19 is the Families First Coronavirus Response Act (FFCRA). This act provides that starting immediately and until December 31, 2020, employees of covered employers are eligible for paid leave in certain circumstances.1

The paid sick leave and expanded family and medical leave provisions of the FFCRA apply to most private employers with fewer than 500 employees. Small businesses with fewer than 50 employees may qualify for an exemption only from the requirement to provide leave due to school closings or child care unavailability if the leave requirements would “jeopardize the viability of the business as a going concern.”2

Federal Reimbursement Policy

The good news is that this required leave is reimbursable for covered employers. Employers qualify for dollar-for-dollar reimbursement through tax credits for all qualifying wages paid under the FFCRA. Qualifying wages are those paid to an employee who takes leave under the Act for a qualifying reason, up to the appropriate per diem and aggregate payment caps. Applicable tax credits also extend to amounts paid or incurred to maintain health insurance coverage.

In addition to the sick leave credit, for an employee who is unable to work because of a need to care for a child whose school or child care facility is closed or whose child care provider is unavailable due to the coronavirus, eligible employers may receive a refundable child care leave credit. This credit is equal to two-thirds of the employee's regular pay, capped at $200 per day or $10,000 in the aggregate. Up to 10 weeks of qualifying leave can be counted towards the child care leave credit. Eligible employers are entitled to an additional tax credit determined based on costs to maintain health insurance coverage for the eligible employee during the leave period.

Reimbursement Procedure

When employers pay their employees, they are required to withhold from their employees' paychecks federal income taxes and the employees' share of Social Security and Medicare taxes. The employers then are required to deposit these federal taxes, along with their share of Social Security and Medicare taxes, with the IRS and file quarterly payroll tax returns (Form 941 series) with the IRS.

Eligible employers who pay qualifying sick or child care leave will be able to retain an amount of the payroll taxes equal to the amount of qualifying sick and child care leave that they paid, rather than deposit them with the IRS.

The payroll taxes that are available for retention include withheld federal income taxes, the employee share of Social Security and Medicare taxes, and the employer share of Social Security and Medicare taxes with respect to all employees.

If there are not enough payroll taxes to cover the cost of qualified sick and child care leave paid, employers will be able file a request for an accelerated payment from the IRS. The IRS expects to process these requests in two weeks or less.3

Conclusion

The many implications of the FFCRA may leave business owners wondering if or how they qualify. Farm Credit East is learning new details every day and is committed to serving our customers any way we can. Continue to monitor Knowledge Exchange’s Today’s Harvest blog for financial services tips, and visit our COVID-19 Resource Hub for the latest updates.

1 Source: US Department of Labor, Wage and Hour Division. https://www.dol.gov/agencies/whd/pandemic/ffcra-employee-paid-leave

2 To qualify for the paid leave limited exemption, an “authorized officer” of the business must determine that; the paid leave would cause your small business to cease operating, would entail a substantial risk to your business’s financial health or operations due to the employees specialized skills or responsibilities, or there are not enough workers who are able to cover the employees requesting paid leave, and your business needs this labor to operate.

(https://www.dol.gov/agencies/whd/pandemic/ffcra-questions)

3 Source: IRS. https://www.irs.gov/newsroom/treasury-irs-and-labor-announce-plan-to-implement-coronavirus-related-paid-leave-for-workers-and-tax-credits-for-small-and-midsize-businesses-to-swiftly-recover-the-cost-of-providing-coronavirus