May 17, 2022

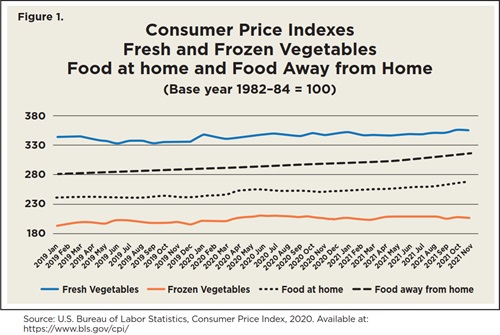

Vegetable markets, similar to many other sectors in food industry, have experienced a range of stressors and supply chain complications over the past two years. Figure 1 illustrates price indices that U.S. consumers have paid for fresh and frozen vegetables between January 2019 and November 2021. From November 2019 to November 2021, we observe an increase in prices of approximately 3.5% for frozen vegetables and a 5.7% increase for fresh vegetables. Over the same time period, we also show price patterns for food consumed at home and food consumed away from home. Prices for food items consumed at home increased by 10.4% overall and prices for food consumed away from home increased 9.8%. These price patterns suggest that prices for vegetable products have been less volatile, and more stable, relative to other food sectors.

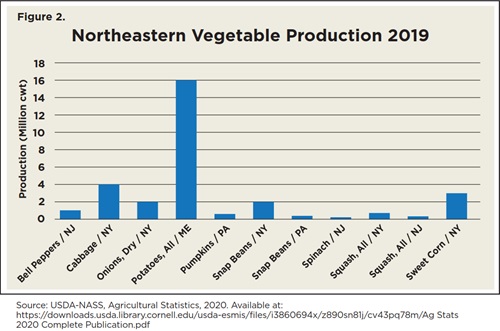

The Northeast is an economically important region for the production, and certainly the consumption, of many vegetable products, both fresh and processed. In the nine states that comprise the Northeast region1, vegetable crops, including potatoes, have generated an annual total farm value of approximately $800 million in recent years. Figure 2 highlights the production of the major vegetable crops that are produced in key Northeastern states. The crops shown in Figure 2 are major contributors to the agricultural economy in their respective states, and they also represent a significant share (i.e., a top ten producer) of the total U.S. production for that crop. In particular, New York is one of the top-five producing states of cabbage, snap beans, and squash; New Jersey is a top-five producing state of bell peppers and spinach.

Ongoing Effects of COVID-19 in Vegetable Markets

The effects of COVID-19 have been substantial for all food categories including vegetables, yet the implications have not been uniform across all individual vegetable crops produced in the Northeast. One of the key drivers determining the impact of COVID-19 for vegetable crops is the relative demand for the product in food retail markets (supermarket sales) versus foodservice markets (institutional and restaurant sales). During much of 2020 and 2021, COVID-19 had much larger effects on vegetable sales in foodservice markets, and a relatively large proportion of vegetable consumption occurs in foodservice markets. The longer-term effects, including the impacts on frozen vegetable sales and the use of vegetables in food prepared at home are yet to be fully understood. However, there is building evidence that after the initial disruption on both demand and supply of vegetables in 2020, prices and shipments for most vegetable crops have returned to levels observed prior to COVID-19 by this point.

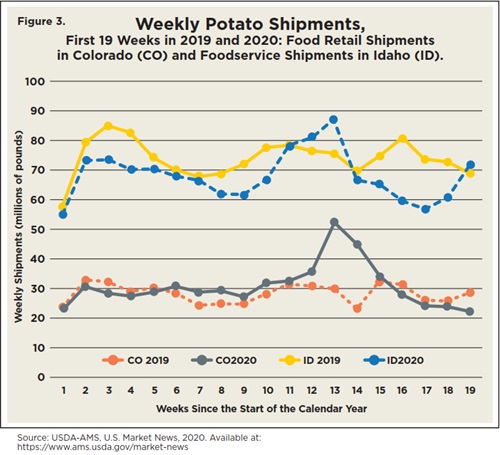

Figure 3 illustrates the effects of COVID-19 in the U.S. potato sector with a specific focus on patterns in the states of Colorado and Idaho in 2019 and 2020 (Colorado represents a source of primarily retail potatoes, and Idaho is a key source of foodservice potatoes). The primary shock began in week 10 in Figure 3 (on about March 10, 2020). Following this initial shock, the data show a rapid decline in potato shipments to foodservice, which are concentrated in Idaho shipping points. Colorado shipments, however, which are more concentrated on retail sales, saw a rapid increase. In the short run, this rise in retail sales of potato products did not offset the foodservice loss. By week 19 of the graphic (May 11, 2020), however, both the positive retail shock and negative foodservice shock had largely dissipated, and shipments returned to normal levels. This does not suggest that foodservice had returned to normal volumes, but rather that shippers had found alternative ways of moving their output from foodservice to retail channels.

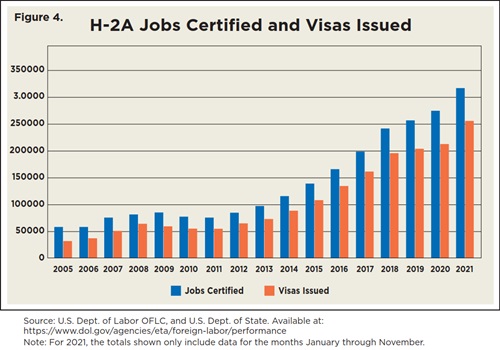

Given the importance of labor to the vegetable sector in the Northeast, a major concern related to COVID-19 is the long run effect on the supply of farm workers. The COVID-19 crisis has heightened the farm sector’s awareness of the importance of being able to recruit and retain a consistent supply of productive, healthy, and well-trained workers. The H-2A visa program is used by many vegetable farm operations in the Northeast; nationally approximately 32,000 guest worker visas were issued in 2005 which has grown to over 255,000 visas by 2021. The COVID-19 crisis fueled a deep concern that growers would not be able to recruit workers from foreign labor markets, however, the data presented in Figure 4 suggest that these concerns have not materialized in practice.

Anticipated Market Trends for Vegetables in 2022 and Beyond

In 2022 and beyond there are three major factors that will continue to shape the vegetable industry in the Northeastern United States. First, at the farm level, a continuous supply of qualified labor continues to be the number-one issue for vegetable growers. For fresh vegetable production in particular, labor represents the greatest share of total production costs. Improvements in technology and the substitution of automated, robotic and intelligent machines for workers will continue to occur at the farm level which could lead to long run reductions in production costs and improvements in crop quality.

Second, for vegetable distribution and related businesses in the middle of the supply chain, there is widespread speculation that we will see additional structural change leading to greater industry concentration. This is part of a longer trend, but it has also been fueled by COVID-19 which has led to a reduction in the number of produce buyers and increased consolidation among major food retailers given their capacity to adapt to an evolving marketplace (including the expansion into online sales). Vegetable farms in the Northeast will continue to have access to fewer and fewer buyers as mergers and acquisitions occur, and this will lead to downward pressure on wholesale and farm-level prices. At the same time, fewer buyers and increased consolidation among food retailers will increase market power for these food distributors with their downstream consumers, and as a result we could see higher prices for vegetables in supermarkets, as the power of retailers grows. Third, future trends in vegetable consumption in the Northeast will be driven largely by income. Recessions (or pandemics) have the capacity to decrease nutritional intake and dietary quality if consumers resort to more calorie-dense “comfort” foods. However, some households during COVID-19 have instead increased the time spent planning and preparing meals at home and there is evidence that this has led to an increase in overall dietary quality and vegetable consumption. A large share of vegetables (approximately 40%) are typically consumed away from home in the foodservice sector, and any rebound of the foodservice industry is expected to increase overall vegetable consumption. Frozen vegetable sales in the food retail market increased dramatically in 2020 and some of that increase was sustained in 2021; this suggests that COVID-19 allowed some consumers to rediscover frozen vegetables and that this category may end up having long run benefits from the pandemic. During the pandemic, many consumers became less interested in certain credence attributes (such as how or where the food was grown). It is expected that we will see a resurgence in demand for local and/or organic fresh produce, and this presents a real opportunity for Northeastern producers that are able to supply these markets.

1 The nine Northeastern states considered here include NY, MA, ME, CT, RI, NH, PA, NJ, and VT.

This paper, along with more highlighting other industry outlooks in the Northeast, can be found in Northeast Agriculture: 2022 Insights & Perspectives.