December 12, 2022

The last few years have created some of the most unpredictable financial situations we’ve seen. As we prepare for 2023, here are five considerations to make in your business planning.

1. Milk prices are falling while input costs rise.

This has been a good year. Most dairy producers will finish 2022 with decent profits and cash flow. It looks like 2023 will be a decent year as well, but milk prices probably won’t be as strong. Futures markets suggest that producer pay prices will fall from the mid-$20s seen in 2022 to the low $20s for 2023. While these are still encouraging prices, rising input costs mean that $20 per hundredweight (cwt.) won’t go as far as it used to.

With everything costing more than a few years ago, money could be tight next year despite the healthy top-line revenue. While the rate of inflation might slow down, the price hikes that have happened are likely here to stay.

2. The era of rock-bottom interest rates might be over.

Recent history has lulled us into expecting low interest rates in perpetuity. That may not be the case.

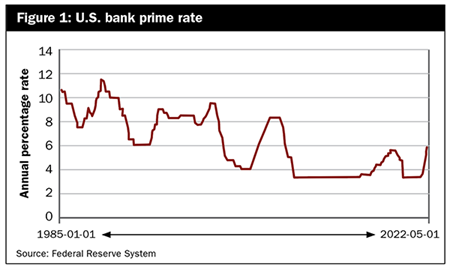

In response to the Great Recession, the Federal Reserve made aggressive cuts to the federal funds rate and kept interest rates remarkably low for an extended period. The U.S. bank prime rate stayed below 4% for nearly 10 years (see figure). It’s almost shocking to remind ourselves that for the 25 years prior the prime rate averaged 8%.

In 2018 to 2019, the Fed began to transition us to a more “normal” rate environment with a series of rate hikes. The prime rate got to 5.5%; then COVID-19 hit and the Fed reversed course.

Recently, in response to inflation, the Fed has started raising rates again, and as of this writing, the prime rate is back to 5.5%. It’s anyone’s guess as to where rates will go from here, but it’s important to consider that the low-rate years we experienced from 2008 to 2017 may prove to have been more of an exception than a normal baseline that we can expect to return to.

3. Save or spend?

In my last column, I talked about tax planning. It may be tempting to take your 2022 earnings and buy a truck or piece of equipment for “tax purposes,” but that might not be the most prudent long-term move.

Buying equipment and taking advantage of accelerated depreciation to reduce your tax liability could be a smart decision. Ideally, though, make investments consistent with the long-term strategy for your business. In some cases, this could mean foregoing a tax write-off to preserve liquidity for the next year.

4. Risk management matters — a lot.

Dairy producers have a range of risk management options available at government-subsidized rates. Take advantage of these options.

Dairy Margin Coverage (DMC), Dairy Revenue Protection (DRP), and Livestock Gross Margin (LGM-Dairy) are available on the dairy side, and there are more options for crops. Each has benefits and limitations, and there’s no single “right plan” for everyone, but spend some time with your advisers to consider what plan or combination will work for you.

Producers can secure “catastrophic coverage” at minimal cost; at least do that. For most, it’s a prudent decision to buy up your coverage at some level to manage the multiple risks you face.

5. You may feel “young at heart,” but it’s time to think about the next generation.

If you’re anything like me, you’re closer to the end of your career than the beginning. Even if you’re just getting started, think about retirement sooner rather than later.

Contemplating your retirement, the future of your farm, and your legacy is important. When you plan to retire, what you want to do, and how you want to live, plus how you will pay for it all, are critical questions to ask. Too many farmers fail to adequately plan for retirement and build savings outside the farm business.

What you want your legacy to be is another important question. Do you want your farm to continue after you retire? Or do you plan to liquidate the operation to fund your golden years? Is there a next generation to succeed you or a nonfamily member who might continue the operation?

The earlier you start planning for a farm transition, the more likely it is to succeed. Think about the transition of not only the farm assets, but the operations and management. It’s important to fully prepare your successor by involving them in all aspects of the operation.

Planning for your own retirement and for the continuation of your farm is inextricably linked. Your farm is much more likely to survive and thrive after the transition if you have adequately prepared (both your successor and yourself) for your retirement. Thinking about off-farm savings, retirement income, and preparing for health care costs will free the farm operation from having to provide you with income when you retire and will help the next generation focus their financial resources on building the business.