June 2, 2021

Dairy Risk Management: Many Options for Northeast Producers

Contents

Volume 15, Issue 6

June 2021

Dairy Risk Management: Many Options for Northeast Producers

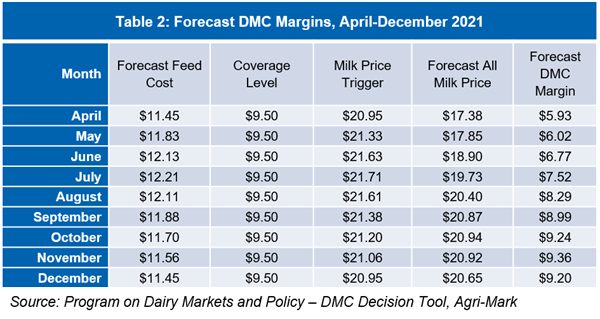

Rising feed costs across the country have resulted in shrinking income-over-feed-costs (IOFC) for dairy producers. This has made risk management programs, including the USDA Dairy Margin Coverage program (DMC), valuable tools in managing dairy margin risk for both milk price and feed cost.

Producers who signed up for DMC and opted for $9.50/cwt. margin coverage will receive $3.04/cwt. in payments for March, as the DMC calculated margin came in at only $6.46/cwt., based on U.S. average milk prices of $17.40 and feed costs of $10.94 per cwt. of milk sold. This is the fourth time the monthly margin has come in below $7.00 over the past 12 months.

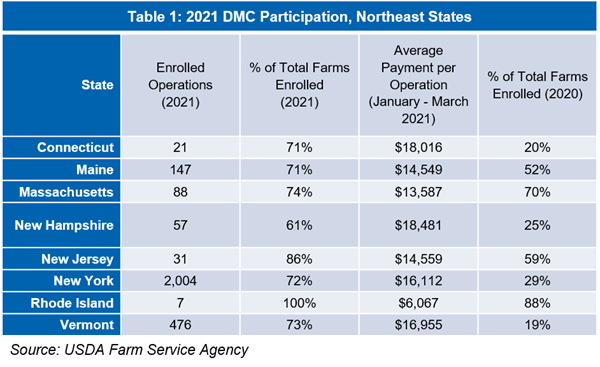

Producers who insured at the $9.50 level have received payments in eight of the last 12 months, from April 2020 through March 2021. As Table 1 shows, coverage has been higher in 2021 compared to 2020’s average Northeast participation of 30%.

Scenarios

Note that payments vary significantly depending on the size of farm and coverage levels selected, but here are a few examples:

Example 1:

Annual Historical Production: 2,500,000 pounds

Coverage Percentage: 95%

Coverage: 23,750 cwt., Tier I: $9.50 margin

Annual Premium: $3,663 or $0.15/cwt.

2020 Program Payments: $16,368 or $12,705 in excess of premium

2021 Program Payments (through March): $16,200 or $12,537 in excess of premium (so far)

Example 2:

Annual Historical Production: 5,000,000 pounds

Coverage Percentage: 95%

Coverage: 47,500 cwt., Tier I: $9.50 margin

Annual Premium: $7,225 or $0.15/cwt.

2020 Program Payments: $32,736 or $25,511 in excess of premium

2021 Program Payments (through March): $32,400 or $25,175 in excess of premium (so far)

Example 3:

Annual Historical Production: 10,000,000 pounds

Coverage Percentage: 95%

Coverage: 95,000 cwt., Tier I: 50,000 cwt. $9.50 margin

Tier II: 45,000 cwt. $5.50 margin

Annual Premium: $12,100, or $0.13/cwt.

2020 Program Payments: $34,919 or $22,819 in excess of premium

2021 Program Payments (through March): $34,105 or $22,005 in excess of premium (so far)

The sign-up period for DMC is in the fall of each year. While it’s too late to sign up or change coverage levels for DMC, there are still a number of risk management options available to Northeast dairy producers.

Dairy Revenue Protection (DRP) and Livestock Gross Margin-Dairy (LGM) are two programs offered by crop insurance agents, with premiums supported by the USDA Risk Management Agency. Producers can combine coverages of multiple programs under certain circumstances.

DRP and DMC can be enrolled in simultaneously. LGM can also be enrolled in at the same time as DRP and/or DMC, as long as they do not cover the same milk production. Your Crop Growers agent can help advise on coverage options.

Dairy Revenue Protection (DRP)

DRP is a federally supported crop insurance program designed to insure against unexpected declines in the quarterly revenue from milk sales relative to a selected coverage level. The “expected revenue” is based on futures prices for milk, and the amount of covered production elected by the producer. It offers two revenue pricing options:

- The Class Pricing Option uses a combination of Class III and Class IV milk prices as a basis for determining coverage and indemnities.

- The Component Pricing Option uses the component milk prices for butterfat, protein and other solids as a basis for determining coverage and indemnities. Under this option, producers may select the butterfat test percentage and protein test percentage to establish insured milk price.

DRP does not take feed costs into account, but rather compares actual milk revenues to those expected based on futures markets. Premiums are supported by the Risk Management Agency from 44 to 55% depending on the coverage level selected, making them more affordable to producers. DRP coverage is selected quarterly, and producers can apply through a crop insurance agent at any time.

As stated above, producers can participate in both the DRP and DMC programs simultaneously.

Livestock Gross Margin-Dairy (LGM)

LGM is a margin-based insurance product. It provides protection when feed costs rise or milk prices drop and can be tailored to any size farm. With LGM, a producer can insure a given income-over-feed-cost (IOFC) margin. Unlike DMC, where producers select a given IOFC margin up to $9.50, with LGM, producers can insure any IOFC margin forecast by futures markets. If the actual margin, as determined by national price levels comes in below the insured margin, an indemnity is triggered. LGM-Dairy is similar to buying both a call option to limit higher feed costs and a put option to set a floor on milk prices.

2018 Farm Bill provisions allow for dairy operations to participate in both LGM-Dairy and Farm Service Agency’s DMC program. However, LGM and DRP cannot be used to cover the same milk production. Producers can sign up for LGM coverage through crop insurance agents at any time, and coverage is selected on a monthly basis.

Producers can also purchase put and call options in the futures markets directly to hedge risk. Some cooperatives offer hedging services and consultations, or you can go to a commodities broker.

Crop Insurance

Finally, when determining risk management options for your dairy, don’t forget the crop side! There are several options available to insure grain or silage production and help manage your risk on inputs and feed on the expense side of the income statement Crop Growers agents are available to assist you in protecting both your milk production as well as your corn and soybean needs.

Editor: Chris Laughton

Contributors: Chris Laughton, Tom Cosgrove and Jeremy Forrett

View previous editions of the KEP

Farm Credit East Disclaimer: The information provided in this communication/newsletter is not intended to be investment, tax, or legal advice and should not be relied upon by recipients for such purposes. Farm Credit East does not make any representation or warranty regarding the content, and disclaims any responsibility for the information, materials, third-party opinions, and data included in this report. In no event will Farm Credit East be liable for any decision made or actions taken by any person or persons relying on the information contained in this report.

Tags: dairy, crop insurance, crop insurance, dairy, dairy