April 4, 2022

Challenging Year Provides Opportunities

Amid the ongoing COVID-19 pandemic, U.S. grains and oilseed markets rallied to multiyear highs this winter on the heels of an unexpected demand-driven shock, supply chain and logistical crises, and overall inflation fears. In early 2021, grain producers were able to plant nearly all expected acreage, racking up 93.4 million corn acres and 87.2 million soybean acres. A relatively favorable growing season across the country enabled a record yield for corn and nearly a record for soybeans. On the export demand side, China was the focus as we shipped tremendous volumes from the Gulf and West Coast. Corn exports increased 54% from 2020 to 2021, and soybean exports rose 35%. Stress on port facilities was a major concern, especially as some older assets were brought back to life to handle the additional workload. Overall, execution was stable and efficient, and grain has made it to destinations overseas. The food-versus-fuel debate has been reignited with the emergence of renewable diesel, an advanced biofuel that is cleaner and more economically viable than traditional biodiesel. Renewable diesel feedstock includes vegetable oils, fats and greases. Biofuel demand for corn — and now oilseeds — continues to be a price driver with gasoline consumption and driving miles returning closer to “normal,” after a dramatic reduction in 2020.

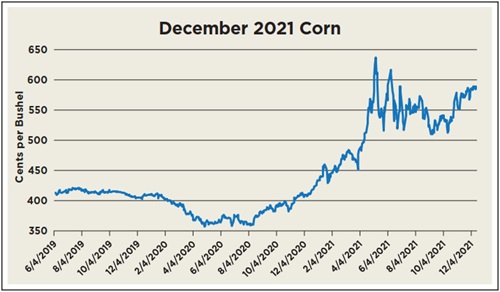

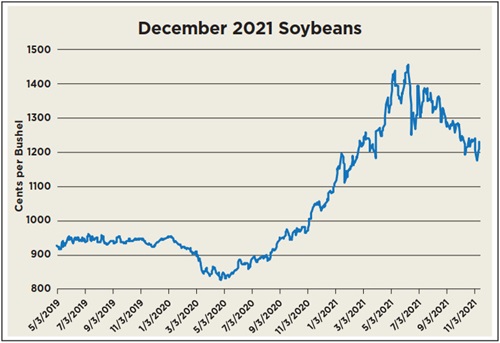

Grain prices began 2021 with roughly $4.70 per bushel corn futures and $13.00 per bushel bean futures trading in the most active contract. During spring planting, the grain market rallied by more than $3.00/bu., hitting a corn high of $7.75/bu. in the nearby contract and soybeans touching $16.77/bu. One would have to look back to December 2012 for the last time those prices traded in Chicago. Harvest contracts (December corn, November soybeans) followed the nearby action.

Biofuels – Moving Around

The energy markets, while also showing recent strength, have struggled to find equilibrium in the tumultuous COVID-19 era. Crude oil prices initially dropped dramatically in 2020, before recovering considerably faster than the market anticipated. Ethanol margins behaved similarly over the period, falling drastically into the red in the low crude environment, only to skyrocket to near-record highs as demand improved and even exceeded pre-COVID-19 levels in some areas. Plant runtimes struggled with staffing and logistical snarls, adding to tightness in the physical market.

Renewable diesel is gaining considerable traction in the marketplace and vegetable oils are already seeing this transition. Overall vegetable oil demand will outpace supply for the next few years. Estimated additional soy crushing capacity slotted to come online in by 2025 will increase soybean oil and soybean meal production by roughly 18%. While the vegetable oil feedstocks have robust demand coming down the pipeline to absorb this increase, soybean meal markets are bracing for a surplus of feed and preparing for export opportunities.

South American Prospects

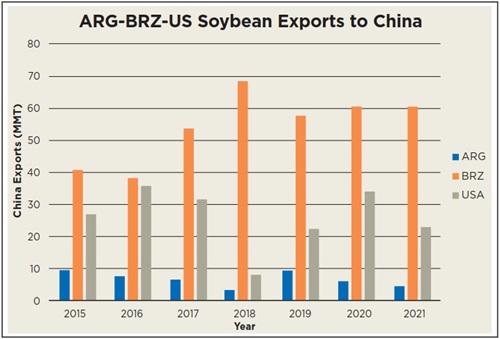

Intense heat and drought have plagued large swaths of Brazil and Argentina, putting significant pressure on production estimates. Recent precipitation provided some relief to the beleaguered crop, but analysts continue to chip away at yields. Weather patterns over the next two to three weeks will determine the final size of the crop, but it’s hard to believe it’s getting bigger. Robust Chinese demand continues to encourage South American soybean production. This past year, Brazil shipped over twice as many soybeans to China than the United States.

2022 WASDE Report

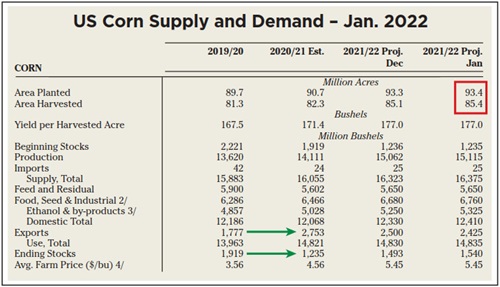

Overall, the historically volatile January World Agricultural Supply and Demand Estimate (WASDE) report left the market with a mundane feeling and relatively small changes to digest. Traders were eager to know South American and World crop projections due to the current weather situation. Regarding corn, U.S. balance sheets remain comfortable with a carryout of 1.540 billion bushels, up 305 million bushels from last year. Final yield for the year came in at 177.0 bushels per acre. Notable changes were a slight decrease in exports offset by an increase in ethanol use. This has been reflected in the cash market as the export program struggles to keep its rapid pace and domestic ethanol margins keep corn in the U.S. On the soybean front, a 0.02 bushels-per-acre yield bump for a final ending yield of 51.4 bushels per acre bumped ending stocks by 10 million bushels for a carryout of 350Mbu. On the international side, Brazil was pegged at 139.00 Million Metric tons, down 6 MMT from December. Argentina followed suit, dropping 2 MMT to 46.50 MMT. These moves decreased total world production by 5% year over year, and -7% from last month’s estimate.

Inputs and the Acreage Battle

Grain prices aren’t the only things going up. Input costs across the country have skyrocketed for many of the same reasons we are seeing in the grain and oilseed space. Supply chain issues, labor, and geopolitical tensions continue to send influence prices, affecting fertilizer and chemicals as well. Anhydrous ammonia spiked 4% recently, hitting a record high of $1,492 per ton. Urea/ammonium nitrate 28% and 32% grades, known as UAN28 and UAN32 respectively, followed closely, trading as high as $601/ton and $699/ton respectively. Reports circulated recently indicated that spring 2022 corn planting costs will be greater than $1,000 per acre for certain parts of the Midwest.

Acreage predictions for 2022 have varied greatly. While the USDA won’t release ‘21/’22 acreage projections until March, early estimates for corn range from 88-94 million acres and soybeans range from 82-90 million acres. The implications of such large swings are obvious on the balance sheets. On the surface, economics generally favor soybeans in a high input environment, as has been the early narrative. But corn, with impressive yield increases across large parts of the Midwest along with a much more stable domestic demand environment, has clawed its way back into planting intentions.

Conclusion

Turbulent times are likely to continue. Supply chain issues are starting to show signs of easing, but labor is a large concern moving into 2022. Inflation is another factor disrupting typical capital flows. In the short term, prices will likely remain seasonally elevated due to weather and planting risk. Longer term, the market needs to figure out if we have shifted the paradigm higher, or if it needs to revert to pre-2019 levels.

This paper, along with more highlighting other industry outlooks in the Northeast, can be found in Northeast Agriculture: 2022 Insights & Perspectives.