November 6, 2025

Grain and Biofuels Outlook: Record Fall Harvest Arrives Amidst Trade Uncertainty, Strong Biofuel Demand

Contents

Volume 19, Issue 11

November 2025

Contributed by Tanner Ehmke, CoBank lead economist grain & oilseeds, Jacqui Fatka, CoBank lead economist farm supply & biofuels

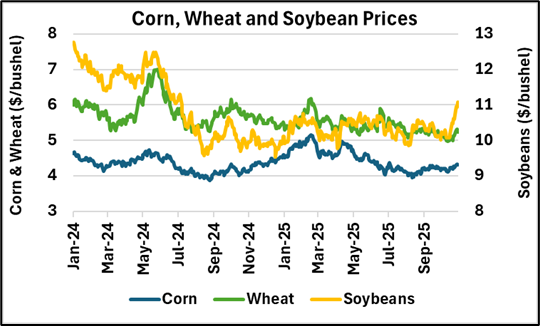

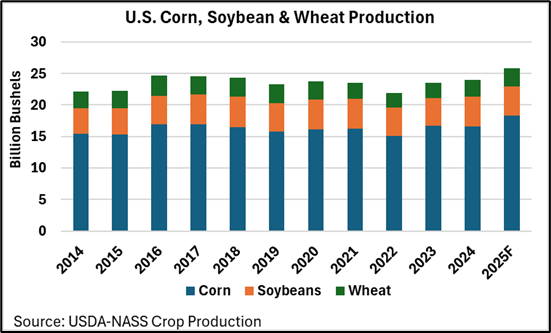

U.S. farmers are harvesting a record-large corn crop and the second-largest soybean crop in five years following the largest wheat harvest in five years. The supply abundance has held grain and oilseed prices at multi-year lows, stressing farm balance sheets when farm production costs remain elevated. Farmers’ displeasure over low prices has resulted in slow farmer selling, which has supported local basis throughout the U.S.

Livestock operators, though, look to benefit from lower feed costs. The demand outlook for corn, soybeans and wheat has been clouded by geopolitical uncertainty on trade for most of 2025. Corn and wheat sales entered the fourth quarter historically strong, aided by a cheap dollar and low rail transportation rates to Mexico, but China’s boycott of U.S. soybeans weakened soybean sales. A trade truce between the U.S. and China offers optimism on soybean exports but a record Brazilian harvest will still compete with the U.S. when the crop arrives in mid-January.

Corn

Record yields on expanded acreage are projected to produce a record corn crop of 16.814 billion bushels this fall, according to USDA-NASS. However, deteriorating crop conditions from corn rust disease and dryness in the eastern Corn Belt has limited yield potential in some regions and trim future estimates on total production. Supply will still be record large and strain storage capacity and logistics.

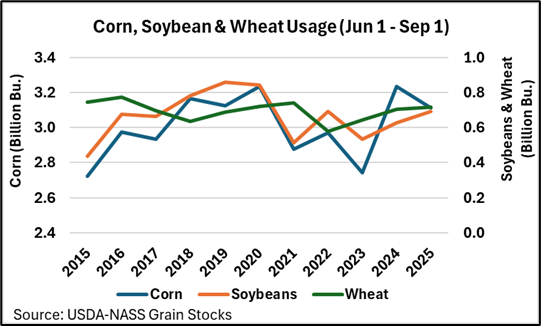

Corn has maintained a remarkable export pace with export sales heading into peak harvest up 77% YoY as top customers Mexico, Japan, Colombia and Korea each showing notable increases in purchases. However, corn’s domestic demand outlook is foundering. Implied corn usage in the last quarter of the 2024/25 marketing year – June to August – fell 3.8% YoY to 3.111 billion bushels despite a robust export program. Grain sorghum is displacing corn in ethanol production, and feed demand faces headwinds of smaller cattle and hog herds and a reduced poultry flock.

Soybeans

The trade truce in October between the U.S. and China was welcomed news for the soybean market that has struggled with stagnant soybean exports in China’s absence as a major customer. Sales to important markets like Mexico, Taiwan, the EU, and Pakistan are up versus prior years but have not replaced lost Chinese demand, which typically accounts for nearly half of annual U.S. soybean exports. China’s pledges of U.S. soybean purchases were met with skepticism after China imported record tonnages from Brazil in the summer and with another record Brazilian soybean harvest in the offing.

The continual expansion of U.S. crush capacity has been a bright spot on soybean demand with two new plants in Nebraska and South Dakota starting operations in the fourth quarter. However, domestic demand cannot substitute the loss of the Chinese export market, with an anticipated three new crush facilities needed to come online overnight to offset the loss in Chinese soybean exports. U.S. soybean crushers have benefited from improved crush margins on growing demand for soybean oil for use in renewable diesel. Ample soybean meal supplies have depressed meal prices, stimulating new export demand while lowering feed costs for livestock operators in the U.S.

Wheat

U.S. winter wheat farmers are planting the 2026-27 crop with acreage expected to drop slightly YoY as falling wheat prices make wheat less competitive to other crops like corn and soybeans. Ample moisture on the Plains, though, may prompt some farmers to reduce fallowed acreage and expand wheat acreage. Midwest wheat producers in the Corn Belt will be motivated to plant a winter wheat crop behind fall harvest to counter low grain prices with more marketable bushels. A winter wheat crop harvested in the early summer also allows farmers to double-crop with soybeans.

Wheat has enjoyed an impressive export pace led by increases in sales to top markets like Mexico, Southeast Asia and Japan. Strong exports and rising export prices in the Black Sea region provide optimism for a turnaround in wheat prices. The arrival of larger crops in Australia and Argentina will create headwinds for wheat’s export pace.

Biofuels

Regulatory policy delays on final renewable volume obligations (RVO) and small refinery exemption (SRE) reallocation are casting a cloud over future demand for biofuels. However, current biofuel demand offers a silver lining on the crop side of the current agriculture economy.

The Environmental Protection Agency proposed 2026 and 2027 RVOs in the summer, anticipating it would release final levels by the statutory deadline of Nov. 1, 2025, but now missed that deadline. The mid-September proposal on SREs seeking comments on 50% or 100% reallocation will push out a final rule on the RVO into early 2026, casting additional uncertainty in demand levels. EPA’s proposed 2026 RVO for biomass-based diesel is more than 2 billion gallons higher than 2025 volumes and the largest year-over-year increase in program history. The trifecta effect of higher RVOs, more restrictive SREs, and mandatory reallocation creates substantially higher biomass-based diesel requirements for 2026 and 2027, potentially 50% higher than 2023-2025 levels.

The proposed RVO rewards only 50% renewable identification number values to imported feedstocks, boosting demand for domestic feedstocks if finalized as proposed. Renewable diesel supply remains tight, with industry sources estimating production capacity utilization near 60% to end the third quarter as producers work through the long transition from the Blenders Tax Credit to 45Z. With the policy shift, domestic margins remain compressed for renewable diesel and biodiesel producers. Production will need to rise heading into 2026 to meet higher projected RVO levels.

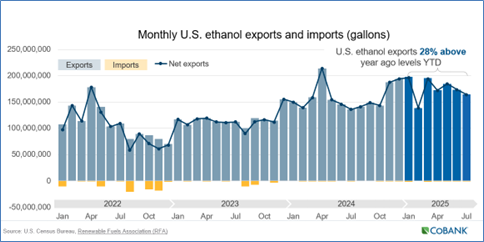

Ethanol margins are projected to stay positive to close out the year, benefiting from plentiful corn supplies from the anticipated record harvest and low natural gas and corn prices. Ethanol exports for the first three quarters of the year are over 10% ahead of the same period in 2024 and on track for a record-breaking year. Through the first seven months of 2025, 13% of domestic ethanol production was exported, compared with a record 12% in 2024 and a pre-pandemic high of 11% in 2018. Canada remains the top buyer of U.S. ethanol, however, increased fuel ethanol exports to the Netherlands accounted for most of the growth from 2024 through July 2025. As the Netherlands has increased fuel ethanol imports from the United States, it has also increased exports to the United Kingdom, France and Ireland.

Ethanol production is projected to consume 33% of the anticipated record corn crop in 2025. The National Corn Growers Association estimates that full E15 adoption would utilize 2.38 billion more bushels of corn or 47.1% of corn use. If year-round E15 could be adopted, it would likely result in a gradual buildup of increased demand. This reality would be a welcomed market stabilizer for producers. Industry groups continue pushing for legislation allowing year-round E15. Although oil industries were united with the ag sector in their backing for nationwide E15, that support splintered in light of the proposed SRE reallocations and higher RVO levels.

Editor: Chris Laughton

Contributors: Tanner Ehmke, CoBank lead economist grain & oilseeds, Jacqui Fatka, CoBank lead economist farm supply & biofuels.

View previous editions of the KEP

Farm Credit East Disclaimer: The information provided in this communication/newsletter is not intended to be investment, tax, or legal advice and should not be relied upon by recipients for such purposes. Farm Credit East does not make any representation or warranty regarding the content, and disclaims any responsibility for the information, materials, third-party opinions, and data included in this report. In no event will Farm Credit East be liable for any decision made or actions taken by any person or persons relying on the information contained in this report.

2026 Grain and Biofuel Outlook Webinar

Tuesday, January 13, 2026

12:00 PM - 1:00 PM EST

Join Farm Credit East, Horizon Farm Credit and CoBank Lead Economists, Tanner Ehmke and Jacqui Fatka, to explore the latest insights on U.S. grain and biofuel markets. This webinar is free and open to all.

Tags: outlook, cash field, ag economy