February 9, 2022

Dairy Margin Coverage Might Not Pay Out This Year: Why it’s More Important than Ever to Consider It

Contents

Volume 16, Issue 2

February 2022

Dairy Margin Coverage Might Not Pay Out This Year: Why it’s More Important than Ever to Consider It

As any dairy farmer knows — dairy can be a risky business. With so many factors affecting your business that are out of your control, it’s important to control what you can and mitigate risk where possible.

There are a number of options out there to help manage the risk of volatile milk prices and feed costs. They include: Dairy Margin Coverage (DMC), offered through the USDA Farm Service Agency; Livestock Gross Margin Coverage (LGM) and Dairy Revenue Protection (DRP), offered through crop insurance agents, such as Crop Growers LLP; as well as futures market hedging, offered through commodity traders and some cooperatives.

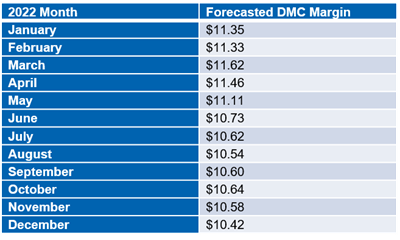

2022 is shaping up to be an interesting year. Milk prices are forecast to be fairly strong by historical standards, but costs are rising as well. While feed costs have certainly risen over the past year, income-over-feed-costs are still likely to remain above the $9.50 maximum trigger level for the DMC program:

Some producers, used to seeing significant payouts from DMC and other risk management programs in the past, may question whether or not it’s worth it to purchase coverage for 2022 given the margin forecasts. The answer is that DMC and other programs should really be viewed as true risk management programs, rather than as opportunities for “playing the odds” of a payout.

While the forecast is for DMC margins to remain above $9.50 in 2022, two things are worth noting: This is a forecast, not a guarantee, and forecasts can change – quickly. Remember in December 2019, 2020 seemed like it was going to be a fairly good year for Northeast dairy. Looking back, this forecast appears remarkably similar to the 2022 forecast. As we now know, the COVID-19 pandemic dramatically changed things, sending DMC margins as low as $5.37 in May 2020. While it appears quite unlikely that we will see similar market disruptions in the coming year, there are still a number of uncertainties that exist regarding the 2022 forecast.

Notably, the surge in input cost inflation makes prudent risk management even more crucial. Producers do not need to be reminded that the cost of just about everything is increasing. Whether it’s fertilizer, supplies, or labor, costs are rising significantly across the board, meaning that a $9.50 DMC margin won’t go as far as it used to.

Given that most risk management programs are based on an income-over-feed-cost margin, when other input costs reduce the value of that margin, it’s even more important to manage your risk.

What to do?

The first decision you may want to make is regarding DMC Tier 1 coverage. The payments for the first 5 million pounds of coverage are very favorable, offering coverage up to $9.50 in margin for 15 cents per cwt. The next step is to consider whether DMC Tier 2 coverage makes sense for your farm, or whether to add an LGM or DRP policy to your risk management plan. Consulting with a crop insurance agent can be a good step in developing a comprehensive plan to manage margin risk to your operation. Looking at your farm operations and finances is also worthwhile. Maintaining adequate financial reserves and managing your cost of production can round out your risk management strategy.

The deadline to enroll for 2022 DMC coverage is March 25, 2022. This year the there is also an option to increase your base period production through a supplemental enrollment. Producers must complete Supplemental DMC enrollment before the 2022 DMC enrollment. All dairy farmers who want to complete the supplemental enrollment or obtain 2022 coverage should visit their local USDA Farm Service Agency office to pay the annual administrative fee, which is $100 for all coverage levels. DRP enrollment is available any business day and LGM is available on a weekly basis through crop insurance agents.

Editor: Chris Laughton

Contributors: Tom Cosgrove and Chris Laughton

View previous editions of the KEP

Farm Credit East Disclaimer: The information provided in this communication/newsletter is not intended to be investment, tax, or legal advice and should not be relied upon by recipients for such purposes. Farm Credit East does not make any representation or warranty regarding the content, and disclaims any responsibility for the information, materials, third-party opinions, and data included in this report. In no event will Farm Credit East be liable for any decision made or actions taken by any person or persons relying on the information contained in this report.

Tags: dairy, crop insurance, crop insurance