February 1, 2021

Northeast Forest Products Industry Review & Outlook

Contents

Volume 15, Issue 2

February 2021

Click here for a PDF version of this month's issue.

Northeast Forest Products Industry Review & Outlook

Written by Paul Jannke, Forest Economic Advisors

Volatility in both consumption and pricing defined North American wood products markets in 2020. As pandemic-related lockdowns brought the economy to a halt in March, mills cut production from 10 to as high as 50 percent, in some cases.

Lockdowns hit pulp markets hard, reshaped by new trends in paper products. Most notably, the pandemic accelerated the decline of graphic paper consumption. The economic contraction led to a rapid shift toward electronic media, fewer paper advertisements, and a decrease in mail volume. However, more time spent at home caused demand to surge for tissue and hygienic products. Similarly, increased e-commerce has elevated paperboard and packaging consumption.

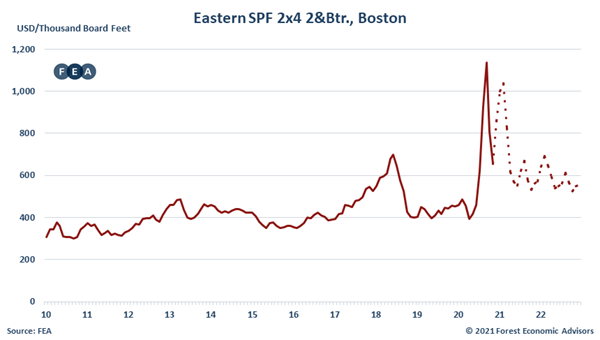

On the softwood lumber side, government stimulus and a precipitous decline in interest rates left many Americans with cash on hand. Stuck at home, homeowners’ expenditures on residential improvements surged. That, coupled with the inclusion of construction as “essential work,” led to a massive increase in demand for wood products. With production already cut and mills hesitant to rapidly restart, dealer inventory plunged to record lows and prices skyrocketed. Production was slow to resume, and COVID-related labor restraints prolonged the shortage, thereby keeping prices elevated.

Still, the residential construction sector has outperformed the rest of the U.S. economy by a wide margin since the pandemic erupted in the spring, and it is expected to continue to do so over the next few years.

Pulp Outlook

Consumption levels for graphic paper are unlikely to return, much like the 2009 recession when consumption dropped 18.4%. Demand for household tissues and hygienic products are expected to decline from their peak during lockdowns, but they are likely to remain elevated in the near term. Paperboard and packaging will remain more robust, trending higher in the near term.

Our current forecast shows paper consumption dropping to 24 million tons (18%) and slipping lower to 23.7 million tons in 2025 despite a recovering economy. In the long term, consumption is expected to continue to fall, albeit at a lower rate.

Conversely, paperboard and packaging production will trend higher over the long term. Despite falling 3.8% in 2020, demand will push upward to 47.4 million tons by 2025. Production is expected to track consumption patterns, increasing nearly 53.4 million tons by 2025, or 8.7% above 2020’s level.

In the Northeast, pulp production challenges — including labor challenges due to COVID-19 — have been exacerbated by the loss of Pixelle’s mill in Jay, Maine. The mill’s digester exploded in April 2020, and the company has announced that it will not rebuild the pulp mill and will permanently idle one of the facility’s paper machines. The other two paper machines will continue to operate using pulp sourced from other pulp mills. The mill represented roughly 20% of Maine’s operational pulp capacity.

Nationally, pulp production continues to fall. Production is expected to decline 8.5% in 2020, then recover over the next two years before it plateaus near 50 million tons. Weaker consumption of paper and expanding capacity in the Southern Hemisphere will limit production.

Softwood Lumber Outlook

Lumber prices will remain high in 2021. Demand will be strong, inventories are at record lows, and production will continue to be hampered by fiber supply shortages. As a result, we expect prices will increase for the year.

While we expect high prices in 2022 relative to historical levels, they will fall from record 2021 levels. The decline is not because of weak demand, rather, we assume mills will increase production to meet rising demand and take advantage of high profitability. With production moving in line with demand in 2022, prices will fall back toward more “normal” profit levels.

Residential construction accounts for 70−75% of U.S. softwood lumber consumption. The two main components of residential construction are new construction and residential-improvement expenditures.

We expect new home construction will be strong in 2021−22. There are a number of reasons for this, including historically low interest rates, decent income growth (especially among potential home buyers), strong demographic tailwinds due to a population bulge just now entering their prime home-buying years, high pent-up demand after a decade of underbuilding, and a low inventory of homes for sale.

In addition, residential-improvement expenditures will remain strong. The average age of the housing stock in the U.S. is 42 years and the average home size of the U.S. housing stock is 1,700 square feet, while the average new home size is nearly 2,500 square feet. The older stock relative to newer homes provides significant incentive to improve and/or add on to a home to bring it up to more modern standards. This is especially true given the high level of equity homeowners currently have.

With end-use market activity remaining strong, we expect domestic consumption will grow 4% per year in 2021−22.

Meanwhile, production will have difficulty keeping up with demand in 2021 as fiber-supply constraints in British Columbia and the U.S. West Coast combine with a lack of residual markets in Eastern Canada to limit potential production growth in regions other than the Southern U.S. Recent investment in new southern capacity will bolster North American production, but it will not be enough to meet demand.

Finally, dealer stocks are at historically low levels. Over the past 20 years, stocks have ranged from a low of 1.12 months’ supply to a high of 2.57 months’ supply. Currently, stocks are a little over half (0.63) a month’s supply. We expect dealer stocks will remain low in 2021 as mill production struggles to meet the anticipated rise in demand. Increased production in 2022 as new southern mills become operational should allow dealers to rebuild their stocks to more “normal” levels.

With demand remaining strong, production having difficulty meeting demand and inventories low, we expect softwood lumber prices will remain elevated relative to historical levels.

Editor: Chris Laughton

Contributors: Paul Jannke, Charlie Hall and Chris Laughton

View previous editions of the KEP

Farm Credit East Disclaimer: The information provided in this communication/newsletter is not intended to be investment, tax, or legal advice and should not be relied upon by recipients for such purposes. Farm Credit East does not make any representation or warranty regarding the content, and disclaims any responsibility for the information, materials, third-party opinions, and data included in this report. In no event will Farm Credit East be liable for any decision made or actions taken by any person or persons relying on the information contained in this report.

Tags: outlook, ag retail, economy, forestry, forestry, lumber