August 8, 2023

Farm Credit East Knowledge Exchange Industry Snapshots

Volume 17, Issue 8

August 2023

The National Economy

U.S. inflation-adjusted GDP growth for the first quarter of 2023, was recently revised upward to 2.0%, marking three consecutive quarters of positive growth. This occurred despite the Federal Reserve’s aggressive interest rate hikes, which have brought the Prime Interest Rate from 3.25%, where it was from March 2020 through March 2022, to 8.25% as of May 2023. The Fed has been raising rates in an effort to combat high inflation, which has been challenging for businesses and consumers alike. While inflation remains well above the Fed’s target of 2.0%, it has declined substantially, from a peak of 9.1% in June 2022, to 4.0% in May 2023. Falling energy costs have been a significant factor in declining inflation. Energy prices declined by -11.7% in May, year-over-year. Food prices continue to increase overall, rising by 6.7% despite significant declines in eggs and dairy products.

The consensus among leading economists is that the probability of a U.S. recession in 2023 has declined compared to earlier forecasts. Goldman Sachs currently forecasts a 25% chance of recession in the next 12 months. Factors positively influencing this forecast are the temporary resolution of the U.S. debt ceiling issue, and the containment of stress in the banking sector after the high-profile failure of several banks. Growth has also received a boost from a growth in consumer disposable income and stabilization of the housing market. Forecasts for overall 2023 GDP growth range from 1.0-1.8% 1

The job market remains extremely tight by historical standards. Headline unemployment was 3.7% in May. Beyond a very low rate of unemployment, there remains a large number of unfilled job openings in the economy. There are currently only 0.6 unemployed workers per job opening nationwide. Put another way, there are just under two job openings for each job seeker, indicating that those seeking employment have a number of options available to them.

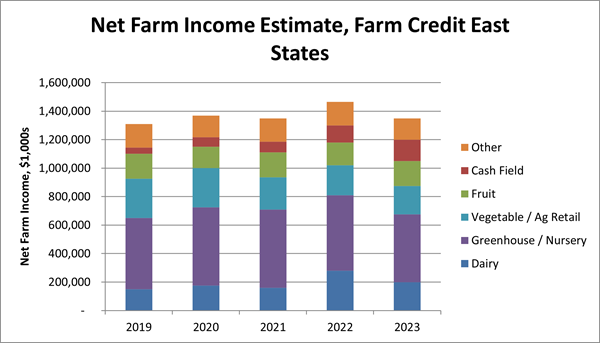

Net Farm Income Projection

Dairy Industry Snapshot

|

Avg. Price per Cwt. |

2021 |

2022 | 2023 April Forecast | 2023 June Forecast |

|

Boston Blend Price2 |

17.84 |

24.96 | 19.98 | 20.07 |

|

Avg. WNY Blend3 |

16.87 |

23.92 |

20.62 | 18.84 |

|

USDA All-Milk Price4 |

18.53 |

25.34 |

20.45 | 19.95 |

- May U.S. milk production increased 0.8% from May 2022. The national dairy herd increased slightly, as did productivity per cow.

- On a state-by-state basis, in May, there were Y-O-Y increases in production in some major producing states, including, Idaho (3.1%), Michigan (2.1%), Texas (0.8%) and Wisconsin (1.3%). Notably, California (-0.7%), and New Mexico (-3.8%) showed declines. In the Northeast, New York (2.1%) and Vermont (0.5%) had increases, while Pennsylvania (-0.6%) showed a decrease.5

- Milk prices have declined considerably from their highs in 2022. Boston Blend price averaged $19.18 in May, down substantially from the peak of $26.36 in 2022. Prices are expected to range from $19-21 for the rest of 2023, and average $20.07 for the year.

- Input costs have risen, tightening margins for dairy producers. Labor, feed and other costs have risen significantly over the last 2 years, and while milk prices have declined significantly, input costs have generally remained elevated. While many producers entered 2023 in a good cash position, they are likely working through their savings to cover costs.

- While 2022 was a remarkably profitable year for Northeast dairy producers, 2023 will be much tighter, and some producers will realize losses. Risk management has taken on greater importance given the sharp downturn in milk prices.

Cash Field Industry Snapshot

USDA Crop Forecast

| National: | 2021/22 | 2022/23 | 2023/24 F |

| Corn Area Harvested (Mil. Acres) | 85.3 | 79.2 | 84.1 |

| Corn Yield/Acre (bu.) | 176.7 | 173.3 | 181.5 |

| Corn Price ($/bu.) | $ 6.00 | $6.60 | $4.80 |

| Soybeans Area Harvested (Mil. Acres) | 86.3 | 86.3 | 86.7 |

| Soybean Yield/Acre | 51.7 | 49.5 | 52.0 |

| Soybean Price ($/bu.) | $13.30 | $14.20 | $12.10 |

Source: USDA WASDE

USDA Planted Acreage

| State & Crop | 2021 Acres (1,000s) | 2022 Acres | 2023 Prospective | % Chg 2022-2023 |

| US – Corn | 105,800 | 100,400 | 103,600 | +3.2% |

| US – Soybeans | 87,200 | 87,500 | 87,500 | -- |

| NY – Corn | 1,040 | 1,030 | 1,100 | +7% |

| NY – Soybeans | 325 | 350 | 355 | +1% |

Source: USDA WASDE

USDA Crop Condition - 18 survey states

| % Good or Excellent | As-of: June 25 | Previous Week | Previous Year |

| National Corn | 50% | 55% | 67% |

| National Soybeans | 51% | 54% | 65% |

| NY – Corn | 71% | 70% | 74% |

| NY – Soybeans | 65% | 63% | 81% |

Source: USDA WASDE

- Prices for grains and oilseeds have declined from last year, with September 2023 corn futures trading at $5.56/bu, and August soybean futures at $13.95/bu.6

- Fertilizer availability has improved and prices have fallen significantly, although they generally remain higher than the 5-year average, depending on the type of nutrients.

- Severe drought in the Midwest could boost prices for major row crops come harvest time, but it is too early to tell what the ultimate impact on yields will be.

Fruit Industry Snapshot

- Tree Fruit: U.S. fresh apple holdings as of June 1, 2023 totaled 29.4 million bushels, 8.6% less

than the inventories reported last year and 3% less than the five-year average. New York apple holdings (total) amounted to 2.7 million bushels, 4% below last year.

India recently announced the end of punitive tariffs on U.S. apple imports. The Indian government imposed a 20% tariff on U.S. apples in 2018 as retaliation for U.S. steel and aluminum tariffs. This will open India back up as a destination for U.S. apple exports, which could help domestic pricing for the 2023 crop. This may be critical, as Washington is projecting a bumper crop this year. - A severe cold snap has killed the flower buds of many peach trees throughout New England and NY, and some growers project that they have lost the entire crop for 2023. NJ peaches were less affected.

- Small Fruit: NJ Blueberries showed strong yields early on, but heavy rains led to soft, lower-quality fruit for some growers. Some brokers were rejecting fruit due to splitting and quality issues. The frost that that hit region impacted many growers of small fruit as well, particularly in New England.

- Wine/Craft Beverage: Early 2023 retail wine sales continue to lag behind the stellar 2020 and 2021 figures. We continue to hear reports of slow sales and less visitation. Some would argue this is the return to normalcy after the pandemic rather than a major downshift in wine consumption. There was a major freeze in several parts of New York and New England that damaged buds on grape vines. Although initial reports indicated severe damage, we are now hearing reports that the grape crop may not be as damaged as originally thought. We do expect a significant decrease this year on tonnage which may affect availability and price of grapes.

- Cranberries: It was a tough frost season, followed by an excessively wet period during bloom. This could affect crop yields, but there is still a lot of the growing season left, so it’s too early to tell what final yields will be.

- Pricing is projected to be stable from the previous year. Handlers are wrestling with increased production costs for juices and other cranberry products due to inflation which may put downward pressures on pricing.

Additional Industry Snapshots:

1 Sources: The Conference Board, Goldman Sachs, Bank of America

2 Agri-Mark Price Forecast

3 Upstate Niagara Price Forecast

4 USDA World Agricultural Supply and Demand Estimate (WASDE)

5 USDA NASS Milk Production Report

6 CBOT Futures

Editor: Chris Laughton

Contributors: Tom Cosgrove and Chris Laughton

View previous editions of the KEP

Farm Credit East Disclaimer: The information provided in this communication/newsletter is not intended to be investment, tax, or legal advice and should not be relied upon by recipients for such purposes. Farm Credit East does not make any representation or warranty regarding the content, and disclaims any responsibility for the information, materials, third-party opinions, and data included in this report. In no event will Farm Credit East be liable for any decision made or actions taken by any person or persons relying on the information contained in this report.

Tags: ag economy, dairy, apple, cash field, fruit, wine